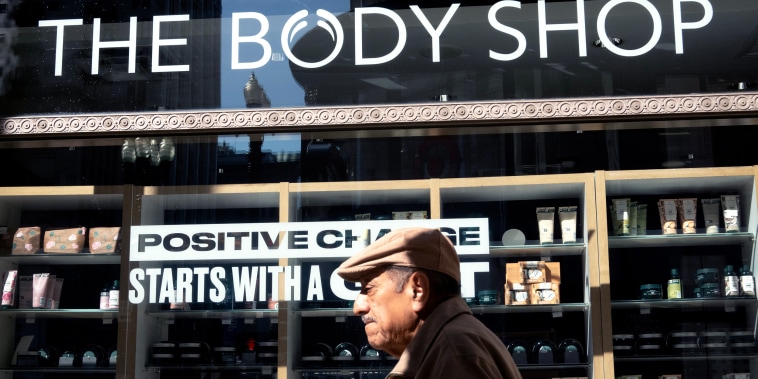

The Body Shop is shutting down its U.S. operations after filing for bankruptcy.

The U.K.-based chain filed for Chapter 7 liquidation in New York last week, according to a court filing. The filing means the company’s U.S. operation will sell off certain assets to pay back its creditors. Earlier this month, the beauty store confirmed it had filed for restructuring in its home country, the United Kingdom, as well as in Canada.

While some stores in those countries will remain open, the chain indicated it was shuttering its remaining U.S. locations.

A Body Shop spokesperson did not immediately respond to a request for comment. According to The Guardian, some 50 locations in the U.S. were operational at the time of the bankruptcy filing.

Launched in 1976 in Brighton, U.K., by entrepreneur and rights activist Anita Roddick (using the name of an earlier store founded in Berkeley, California), Body Shop was acquired for the equivalent of $1.3 billion in 2006 by beauty giant L’Oréal. It subsequently changed hands again before being acquired by a private equity group in December for approximately $250 million.

But the company collapsed in February, with administrators citing mismanagement and a challenging retail landscape.

“The Body Shop has faced an extended period of financial challenges under past owners, coinciding with a difficult trading environment for the wider retail sector,” the administrators said in a statement according to Reuters.