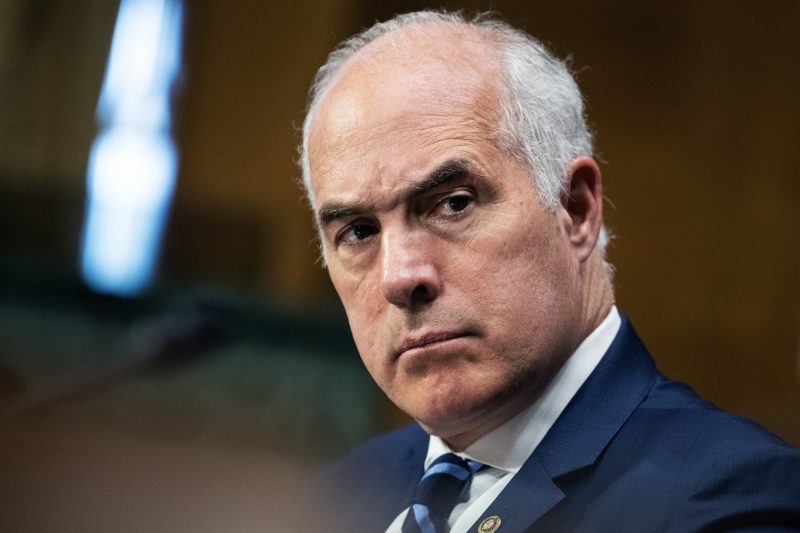

Pennsylvania Sen. Bob Casey has sent letters to Amazon, Target and Walmart over concerns that pricing decisions made at the retail giants since the pandemic may have been driven by aggressive push for profits at the expense of everyday Americans’ wallets.

Casey, a three-term Democrat who is in a tight re-election battle that could tip his party’s razor-thin majority in the Senate, says in the letters that between June 30, 2020, and June 30, 2022, corporate profits in the United States rose by 75%, roughly five times as fast as inflation, and that the three megaretailers were among the beneficiaries of that phenomenon, which he called ‘greedflation.’

Amazon, Casey said, has seen its profits increase as much as 61% over that time period, while Target’s profit increased 31.7% and Walmart’s was up 10%, which was about 25% higher overall than they were pre-pandemic.

Meanwhile, an average Pennsylvania family has paid almost $7,000 more ‘toward greedflation,’ Casey says.

‘Americans deserve to pay fair prices, and corporations must be held accountable for taking advantage of working families,’ he writes.

In a follow-up interview with NBC News, Casey went even further, questioning whether the companies may have been engaging in price gouging.

‘Someone’s got to be the cop on the beat here and create a measure of pressure and deterrence for these skyrocketing prices,’ he said. ‘If they’re not engaged in gouging, then they have nothing to worry about,’ the senator said about the retailers.

In a statement, Amazon said: “We work hard every day to offer low prices in our store. Third-party analysis confirms Amazon consistently delivers low prices.’

‘For seven consecutive years, an independent study from Profitero found prices in Amazon’s store to be the lowest online prices among all major U.S. retailers, with prices that were an average of 16% less expensive than competitors’ in 2023.’ the company said.

NBC News has also reached out to Target and Walmart for comment.

There remains debate about the root causes of the soaring consumer prices that have occurred since the pandemic. Most economists have blamed a confluence of factors that include acute supply chain disruptions — and resulting shortages — sparked by the economic slowdown during the pandemic, alongside aggressive fiscal and monetary stimulus enacted to prevent a recession.

In a recent interview with the Financial Times, Olivier Blanchard, an economist at the Massachusetts Institute of Technology, captured the lingering uncertainty about how much each of those factors has contributed to the price surges.

‘How much came from Covid shock, supply chain disruptions? How much came from strong fiscal policy or weak or loose monetary policy? I think this hasn’t been established and that remains to be done,’ he said.

As for ‘greedflation,’ Blanchard acknowledged that corporate profits have increased sharply but that this was largely unavoidable.

‘You may disagree, you may hate it, but it’s the way the market works,’ he said. ‘Nobody is trying to school the consumers. It just happens.’

Casey argues corporations have gone too far.

‘Price increases that consumers have been confronted with have not been inflationary increases but, instead, greedflation-related increases,’ he writes. ‘It is now readily apparent that corporations have long had the ability to lower consumers’ costs and still turn a profit.’

Amazon, Target and Walmart have each recently announced moves to lower prices for certain goods or release new value-based products.

But Casey is seeking information about the specific decision-making process that led to those announcements: whether it was in response to economic conditions or simply to ward off negative press.

‘I don’t think this is interfering in business decisions — we’re not looking at setting prices,’ he said. ‘We’re just telling them that if they’ve been involved in price gouging, there are going to be consequences.’