Plug Power (PLUG) stock price is having another difficult year as concerns about its industry and balance sheet remain. It crashed to $1.7 on Monday, its lowest level since April 2017 and 97% below its all-time high. Its market cap has dropped from over $42 billion in 2021 to $1.4 billion, making it one of the worst-performing energy companies.

Hard being a disruptor

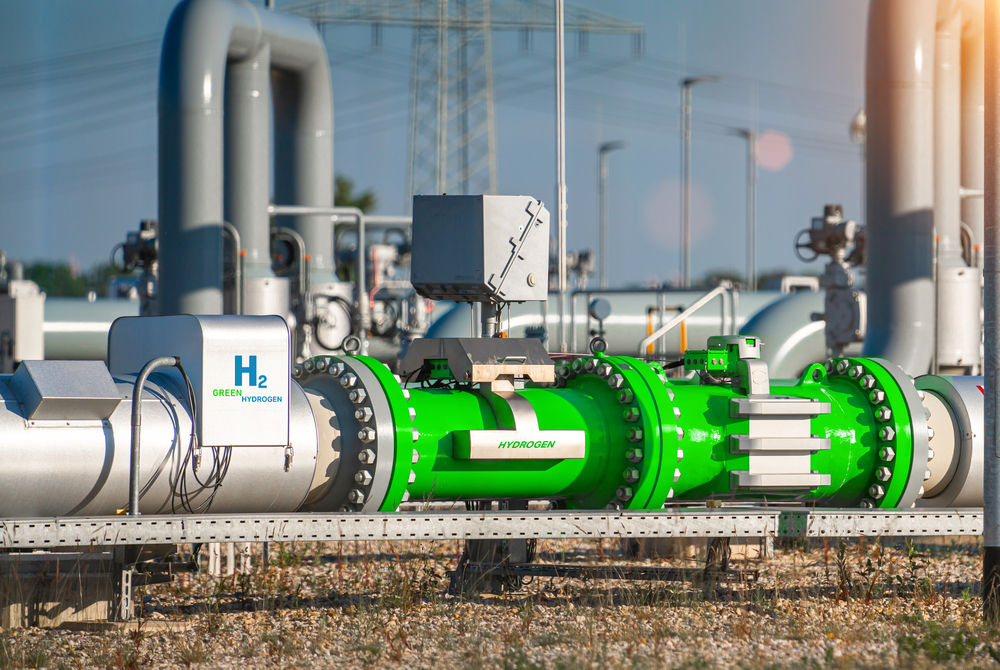

Plug Power is a high-profile company that aims to become a disruptor in the energy industry. The company’s goal is to become the biggest player in the hydrogen industry, by building solutions like fuel cell systems, green hydrogen production, and hydrogen infrastructure.

Hydrogen has always been touted as a major player in the clean energy industry because it does not have dirty emissions. It can be used in large industries, vehicles, and equipments like forklifts.

Plug Power’s challenge is that it is building the green hydrogen infrastructure from scratch, a highly complicated and expensive to execute. Over the years, the company has announced substantial losses. Data by SeekingAlpha shows that its annual losses totaled over $3.8 billion in the last financial years.

Its performance goes to show how hard it is to become a disruptor in any industry. In particular, disrupting the energy sector is more difficult because the company needs to create green hydrogen locations. It also needs to build the infrastructure to support its distribution.

The other big issue is that making green hydrogen is highly expensive. Data shows that conventional and blue hydrogen costs about $2 per kilo while green hydrogen costs more than double.

More dilution in the horizon

Plug Power investors are used to increased dilution, where the company raises money by selling new shares.

Data shows that the company had over 228 million common shares outstanding. Today, the number has increased to over 787 million today. This means that its outstanding shares have jumped by over 285%.

When dilution happens, existing shareholders have smaller ownership of the company, reducing their voting power. It also reduces their earnings per share.

For example, assuming that Plug Power made an annual profit of $1 billion in 2017, it means that the earnings per share would have been $4.46. Today, with the outstanding shares at 787 million, it means that the EPS is $1.27.

Plug Power’s investors have benefited from the Department of Energy (DoE), which awarded it with $750 million in funding. These funds have helped the company boost its balance sheet as costs remain significantly elevated.

Still, the DoE funding has not prevented the company from diluting its shareholders. In July, the company announced a plan to sell additional shares to fund its development.

The company will likely need more money in the next few years. It ended the last quarter with $62.35 million in cash and cash equivalents, down from over $135 million in the December quarter. Its restricted cash rose to over $222 million while its total current assets stood at over $1.6 billion

Plug Power has substantial liabilities, including long-term debt of over $208 million, finance obligations of $245 million, and lease obligations of over $295 million

PLUG earnings download

The most recent results showed that Plug Power’s revenue came in at $143 million, down from $260 million in the same period in 2023. Its six-month revenue fell from $470 million to 2023 to over $263 million.

The sharp decline in revenue was notable because the company started its hydrogen deliveries from its Georgia and Tennessee plants in 2023. Its fuel sales rose to $29 million in the last quarter and to $48 million in the first half of the year. The revenue decline was because of a sharp fall in equipment and related infrastructure sales.

Plug Power’s quarterly loss jumped to over $262 million while the weighted average number of outstanding shares jumped to 736 million from 593 million in the first half of 2023.

Therefore, while the Plug Power stock price is cheap, there is an elevated risk that it might be a value trap since more dilution is expected to happen.

Plug Power stock price analysis

The weekly chart shows that the PLUG share price has been in a steady downtrend in the past few years. It has dropped from a high of $75.45 in 2021 to below $2 today. As a result, the stock has remained below all moving averages, meaning that bears are in control.

On the positive side, the stock has formed a falling wedge chart pattern and has a whopping 26% short interest. This means that it may become a good candidate for a short squeeze, especially when the Federal Reserve starts to cut interest rates later this month.

My argument is that, while there is merit to short the Plug Power stock price, there is also a big risk of it going parabolic in the near term.

The post Plug Power stock is risky, but a short squeeze can’t be ruled out appeared first on Invezz