Shares of VAT Group AG (SWX: VACN) have taken a 25% hit since mid-July, creating what analysts see as a golden opportunity for investors to buy into a high-quality company at a discount.

With the Swiss firm deeply entrenched in the artificial intelligence (AI) chips supply chain, many believe its stock is poised for significant growth, making it a solid investment choice despite recent setbacks.

Michael Foeth, an analyst at Vontobel, is among those who remain optimistic about VAT Group’s prospects.

In a recent research note, he described AI as “the biggest technology shift of our lifetimes” and predicted that the global semiconductor industry could reach a $1 trillion valuation by 2030.

VAT Group, as a key supplier of vacuum valves used in chip manufacturing, is well-positioned to benefit from this rapid growth.

VAT’s exposure to AI is an advantage

Foeth expects AI-related semiconductors to account for up to 40% of the global chip market by 2027, and VAT Group stands to gain as the demand for these technologies increases.

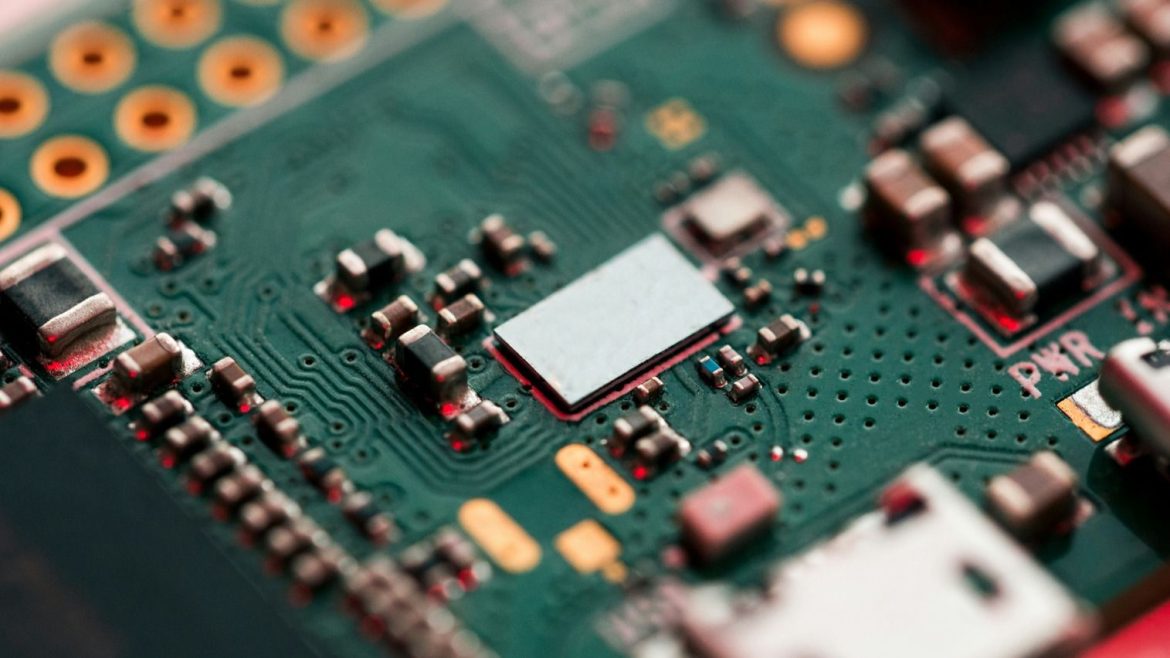

The company, headquartered in Haag, Switzerland, produces vacuum valves that play a crucial role in creating ultra-clean environments for semiconductor manufacturing.

Companies like Lam Research rely on VAT Group’s products for their chipmaking processes, further solidifying its position in the AI supply chain.

While other companies like Inficon and Comet are also expected to capitalize on the AI boom, Foeth sees VAT Group as the standout.

He notes that VAT’s exposure to the AI market is far greater, giving its stock more upside potential.

VAT Group, which is also listed on US exchanges, currently offers a dividend yield of 1.59%, making it an attractive option for income-focused investors. The combination of this yield with its growth potential adds to its appeal at current valuations.

According to Jefferies, another firm with a bullish outlook, VAT Group’s stock could surge to CHF 700, representing an 80% increase from current levels.

Jefferies analyst Olivia Honychurch estimates that if you invested $1,000 in VAT Group today, you could see that investment grow to $1,800 by September 2025.

And that figure doesn’t even include the additional returns from dividends.

VAT stock could rally 80% from here

VAT Group’s recent financial performance further strengthens the investment case.

In its July earnings report, the company posted a 75% year-over-year growth in quarterly orders, reaching CHF 271 million.

It also raised its full-year guidance, forecasting increases in sales, net income, EBITDA margin, and free cash flow.

Insider ownership in VAT Group currently stands at over 10%, which often signals confidence in the company’s future.

The semiconductor giant continues to benefit from expanding capital investments across the industry, further supporting its long-term growth outlook.

The semiconductor sector, particularly AI-driven technologies, remains a hot investment area.

VAT Group’s deep involvement in this space and its strong financials suggest that now could be an opportune time for investors to buy in at a discount.

The post VAT stock: This Swiss semiconductor company could turn a $1,000 investment into $1,800 within a year appeared first on Invezz