Icahn Enterprises (NASDAQ: IEP) stock price is falling apart as concerns about its dividend safety continues. It has crashed to $10, down by over 40% this year and by over 53% in the last 12 months.

Most notably, IEP has dropped in the last four consecutive weeks and is down by over 73% from its highest point in 2023. This crash has brought its market cap from last year’s high of over $18 billion to $4 billion.

Perils of yield chasing

Icahn Enterprises is a good example of the perils of yield chasing as the company has a dividend yield of 38%, making it one of the biggest yielders in Wall Street.

A 38% yield means that a $10,000 invested in the company should pay about $3,800 in a year, if it remains constant.

However, while this is a good return, investors are often exposed to a big risk, with default and bankruptcy being the biggest ones. As a result, what the stock gives you in dividends, it takes it back in the lagging stock performance.

In Icahn’s case, the total return, which includes the stock price action and dividends, has dropped by over 41% in the last 12 months. In the same period, the S&P 500 index has jumped by over 22.4%

This happens because of how a dividend yield is calculated. It is calculated by dividing a company’s annual dividends per share and the stock price per share and then multiplying the result by 100%.

Why Carl Icahn’s company is imploding

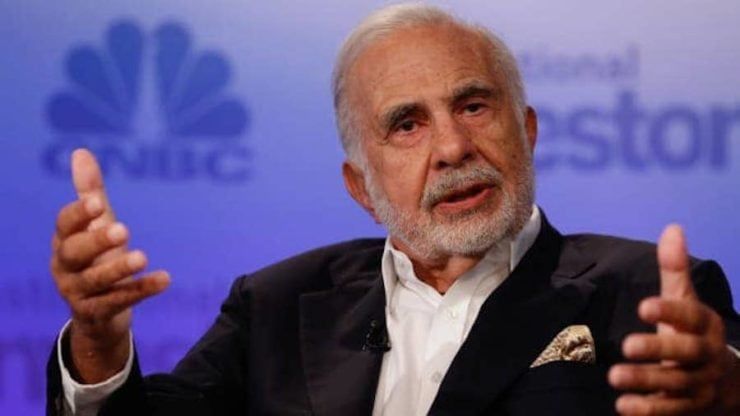

The IEP stock price action brings the sad reality to one of the most prominent players in Wall Street. Born in 1936, he grew to become one of the top corporate raiders in the United States, especially after his takeover of Trans World Airlines, which filed for bankruptcy during his ownership.

Over time, he transformed from a corporate raider into a highly-feared activist investor, where he bought small stakes in companies and advocated for changes, including the firing of CEOs. Some of his most popular activist plays were with companies like Cheniere Energy, CVR Energy, and Xerox.

Most recently, however, Carl Icahn has been fighting to save his company, which owns stakes in several large companies in the US. Some of the top companies in the portfolio are CVR Energy, where he is the biggest shareholder, Southwest Gas, International Flavors & Fragrances, Bausch Health, Dana, JetBlue, SandRidge Energy, and American Electric Power.

Most of these companies are not doing well. Bausch Health, formerly known as Valeant Pharmaceuticals, has crashed by over 82% from its highest point in 2021 and is hovering near its all-time low.

CVR Energy shares have plunged by over 40% from their highest point this year while JetBlue has fallen by 74% from its 2021 highs. The company has come under pressure following its botched attempts to buy Spirit Airways.

Southwest Gas Holdings has also dropped by almost 10% from the year-to-date high. While International Flavors has bounced back this year, it remains 28% below the highest point in 2021.

Other companies in Carl Icahn’s portfolio like Caesars Entertainment and Centuri Holdings have all plunged.

Carl Icahn’s debt and fine

The Icahn Enterprises stock price was doing relatively well until 2023 when Hindenburg Research published a scathing attack of the company.

In the report, Hindenburg accused Icahn Enterprise for operating like a ponzi scheme. He also noted that Carl Icahn had borrowed substantial sums of money by using the IEP stock as collateral and failed to disclose them.

The Securities and Exchange Commission (SEC) then started investigating the company, and this month, agreed to a $2 million settlement. Icahn also agreed to avoid future violations.

Meanwhile, the soaring dividend yield means that investors worry that the Icahn Enterprises may be forced to sell stakes at a big loss or even file for bankruptcy. Looking at its balance sheet, we see that the company has total liabilities of over $12.6 billion against total assets of $17 billion.

Its liabilities include $6.5 billion in long-term debt and $598 million in capital leases. Most notably, the company faces some heavy maturities in the coming years that will need to be paid. It has $6.37% senior unsecured notes worth $749 million maturing in 2025, $1.2 billion in 2026, and $1.4 billion in 2027. The next maturities will be $708 million and $698 million in the next two years.

IEP stock technicals

Worse, the Icahn stock price has some weak technicals. It has crashed from last year’s high of $38 to just $10. Most recently, the stock has plunged below the key support level at $12.67, its lowest swing in December last year.

IEP has remained below the 50-day and 100-day Exponential Moving Averages (EMA), meaning that bears are in control. Therefore, the path of the least resistance for the stock is downwards, with the next point to watch being at $8.

The post IEP yields 38%: why is Carl Icahn’s stock falling apart? appeared first on Invezz