AI chip startup Cerebras Systems has filed for an initial public offering (IPO), signaling its ambition to compete with industry giant Nvidia.

Cerebras Systems reported more than a threefold increase in its annual revenue for 2023, the AI chipmaker revealed in its filing for a US initial public offering on Monday.

According to a prospectus filed on Monday, Cerebras plans to list on the Nasdaq under the ticker symbol “CBRS.”

Cerebras is positioning itself as a strong contender in the competitive AI chip sector, which has been largely dominated by Nvidia’s graphics processing units (GPUs).

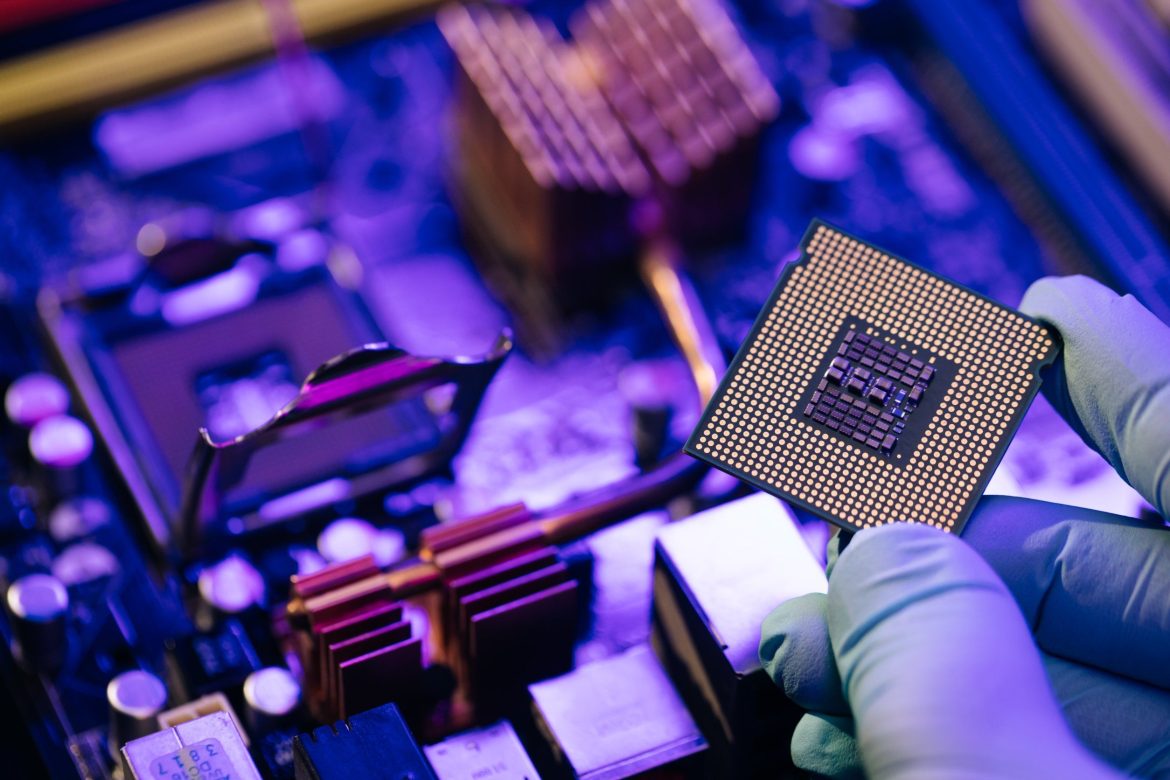

The company claims its third-generation WSE-3 chip surpasses Nvidia’s popular H100 in terms of cores, memory, and physical size. In addition to selling chips, Cerebras offers cloud-based services powered by its own computing clusters.

Financial performance and challenges

The company’s financial results reveal both potential and challenges. Cerebras reported a net loss of $66.6 million in the first six months of 2024 on $136.4 million in sales.

This is an improvement compared to the same period in 2023, where the company experienced a net loss of $77.8 million and sales of just $8.7 million.

For the full year of 2023, Cerebras posted a net loss of $127.2 million on $78.7 million in revenue.

In the second quarter of 2024, the company faced a $50.9 million loss, with revenue reaching $69.8 million—up from a $26.2 million loss and $5.7 million in revenue for the same period a year earlier.

Cerebras attributes its rising operating expenses to higher personnel costs needed to support its growing revenue.

However, it remains unprofitable, and its ability to scale while managing costs will be a key focus for investors.

Competitive landscape and strategic partners

The AI chip market is fiercely competitive, with cloud providers like Amazon, Google, and Microsoft developing their own AI chips.

Cerebras also identifies AMD, Intel, Microsoft, and Google as competitors, alongside a range of private companies creating custom AI chips.

Cerebras has a key relationship with Group 42 (G42), a UAE-based AI firm that accounted for 83% of its revenue in 2023.

In May 2024, G42 committed to purchasing $1.43 billion in Cerebras products by March 2025, solidifying its role as a major partner.

Supply chain risks and key investors

Cerebras manufactures its chips through Taiwan Semiconductor Manufacturing Company (TSMC).

The company has warned potential investors that any supply chain disruptions could have significant impacts on production.

Founded in 2016 and based in Sunnyvale, California, Cerebras is led by Andrew Feldman, its co-founder and CEO, who previously sold server startup SeaMicro to AMD for $355 million in 2012.

Cerebras was valued at over $4 billion in a 2021 funding round.

Major investors include Foundation Capital, Benchmark, Eclipse Ventures, Alpha Wave, and Coatue. High-profile backers like OpenAI CEO Sam Altman and Sun Microsystems co-founder Andy Bechtolsheim have also invested.

Feldman remains the only individual owning more than 5% of the company.

The post AI chipmaker Cerebras Systems files for IPO to challenge Nvidia, records threefold revenue jump appeared first on Invezz