On October 2, 2024, Truist analysts raised their price target for Monolithic Power Systems (NASDAQ: MPWR) to $994, up from $914, representing a potential upside of more than 10% from the previous day’s close.

Following the announcement, MPWR shares saw a 3% gain in early trading. The analysts cited better-than-expected end-market growth, driven by strong client computing and communications demand.

Truist reiterated their Buy rating, confident in MPWR’s continued success in securing design wins, especially in the AI and enterprise data markets.

Strong analyst support for MPWR

Truist is not alone in its bullish outlook. Stifel, after meeting with Monolithic Power’s senior management, also reiterated a Buy rating with an even higher price target of $1,100.

Stifel highlighted MPWR’s innovation in high-performance analog technology, positioning the company as a leader in systems-level solutions.

The firm believes MPWR could outgrow the broader analog semiconductor market by 10% to 15%, with artificial intelligence and enterprise data as key growth drivers.

Oppenheimer echoed similar sentiments after MPWR’s Q2 earnings report, praising its performance amid industry-wide challenges, maintaining a $900 price target.

MPWR Q2 earnings beat expectations

Monolithic Power Systems delivered strong results for the second quarter of 2024, with non-GAAP earnings per share (EPS) of $3.17, exceeding estimates by $0.10.

The company reported revenue of $507.43 million, a 15% year-over-year increase, and well above Wall Street’s consensus estimate of $490.55 million.

Gross margins came in at 55.3%, slightly lower than the previous year but consistent with the company’s guidance.

Operating income also rose by 22% compared to Q1, indicating efficiency gains despite rising operating expenses.

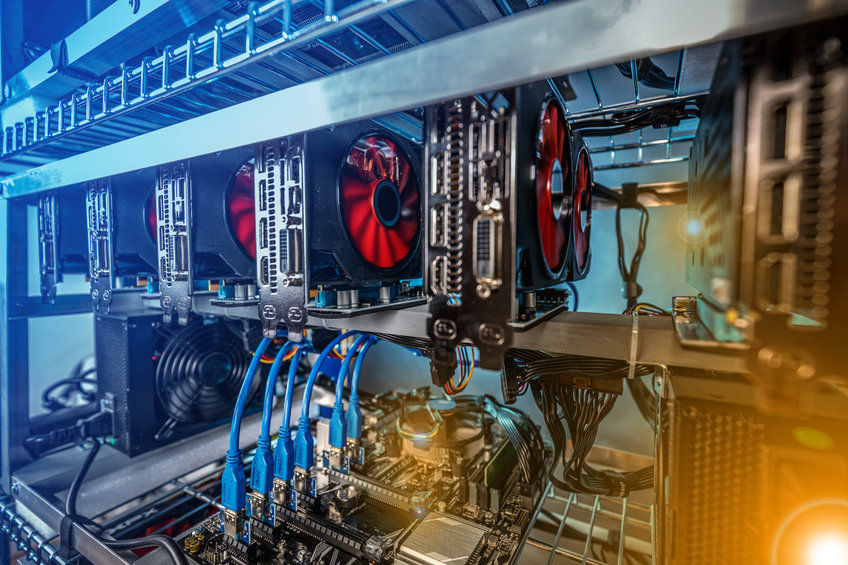

A key driver of MPWR’s recent performance is its exposure to high-growth segments like artificial intelligence and data centers.

In Q2, MPWR saw significant revenue growth in enterprise data, which accounted for over 37% of its total sales.

This segment alone grew by more than 250% compared to last year, driven by increasing demand for AI-related server products.

The company’s shift from being a chip supplier to a full solutions provider has allowed it to capitalize on this growing demand, positioning it for continued market share gains in these high-growth areas.

Geographical divergence in growth

Interestingly, while MPWR experienced robust growth in markets like China and Taiwan, other regions, including the U.S. and Europe, saw revenue declines.

China and Taiwan alone contributed to the majority of the company’s overall revenue increase.

China posted a 30% year-over-year revenue jump, while Taiwan’s sales nearly doubled, driven by strong demand for high-performance computing applications.

In contrast, markets like Japan and Southeast Asia reported declines of over 50%, raising concerns about how reliant MPWR’s growth may be on certain regions.

MPWR stock: valuation metrics and growth potential

Monolithic Power’s stock has surged over 45% year-to-date, significantly outpacing the semiconductor sector’s average gains.

However, this performance has pushed the company’s valuation to lofty levels.

MPWR currently trades at a forward P/E ratio of 63.7x, far higher than the industry average.

Similarly, its price-to-book ratio stands at 19.77x, which is considerably higher than peers like Analog Devices and Texas Instruments, whose multiples hover around 3x to 10x.

Despite this premium valuation, MPWR’s consistent track record of revenue growth, coupled with robust demand from AI and data centers, has led analysts to maintain optimistic projections for 2025.

Cash position and shareholder returns

Monolithic Power’s solid financial footing strengthens its growth outlook.

The company ended Q2 with over $1.3 billion in cash and minimal debt, allowing it to invest heavily in research and development while also returning value to shareholders through dividends and share buybacks.

In 2024, MPWR increased its dividend by 25%, although its yield remains lower than historical averages due to the recent surge in share price.

The company’s free cash flow generation remains strong, even as it ramps up capital expenditures to support future growth.

MPWR stock: strong financial outlook

Looking ahead, MPWR’s management has guided for third-quarter revenue between $590 million and $610 million, a significant increase from the $507.43 million reported in Q2.

If achieved, this would represent an all-time high for the company. With projected gross margins in the range of 55.2% to 55.8%, MPWR appears well-positioned to maintain profitability despite industry-wide challenges.

Analysts expect EPS to continue rising, with projections for FY2025 at $17.51, representing over 25% growth from current levels.

As we assess MPWR’s strong financial performance and analyst support, it’s essential to examine the stock’s price movements more closely.

Now, let’s see what the charts have to say about Monolithic Power Systems’ price trajectory.

Consistent compounder

MPWR has been one of the best-performing stocks within the semiconductor industry delivering over eightfold returns to investors since the start of 2018.

Source: TradingView

The stock exhibits strong upward momentum across time-frames. However, it has recently faced some resistance near the $954 level having retraced from that level twice in the past few weeks.

Therefore, investors who are bullish on the stock but haven’t bought it yet should only initiate a small long position at current levels with a stop loss below $758.

They can add to this position once the stock gives a decisive breakout above $954.

Traders who have a bearish view of the stock do have a low-risk entry on their hands right now, but the chances of this trade being profitable are slim.

They can initiate a short position near $920 with a stop loss at $256.6 and a profit target of $760.

The post Monolithic Power Systems’ price target raised to $994 by Truist: Is this a buy signal? appeared first on Invezz