Cerebras Systems Inc. – a California-based artificial intelligence company is seeking to go public in the US at a valuation of about $8.0 billion in 2024.

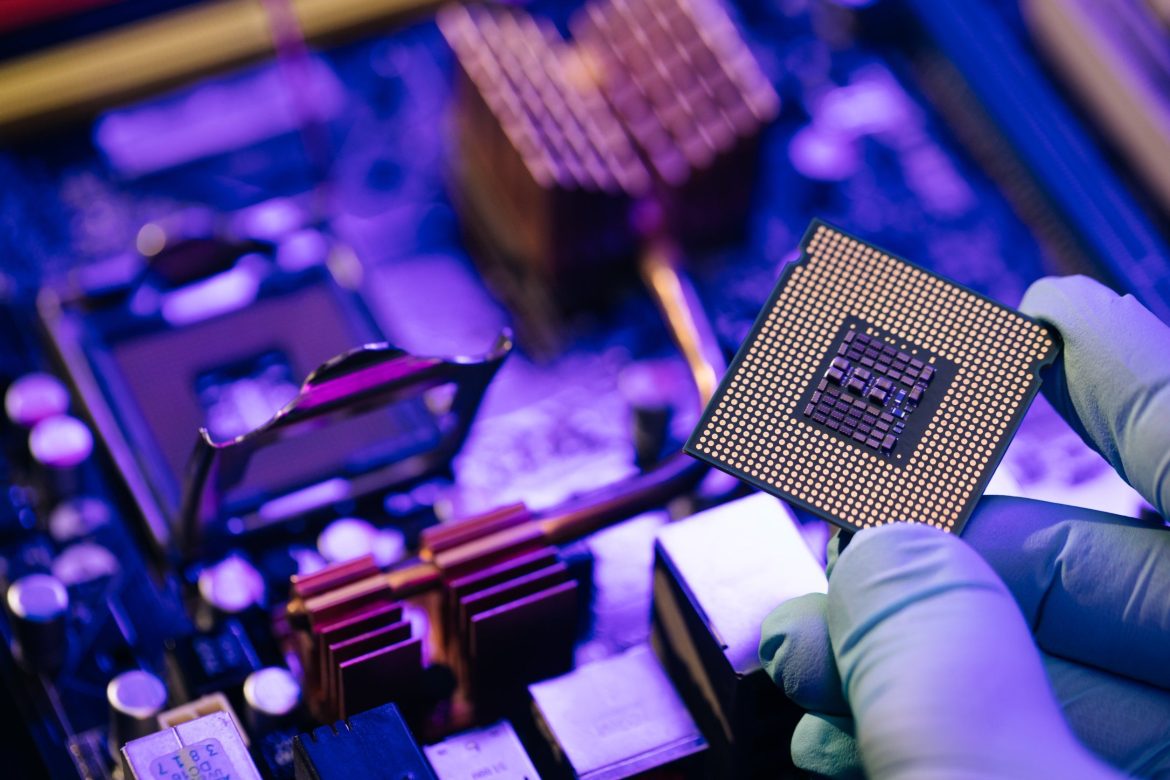

The venture-backed firm specializes in chips that are used for training large language models and even claims its product to be faster on that front compared to Nvidia.

Still, I wouldn’t want to invest in the initial public offering of Cerebras Systems whenever the opportunity materializes.

That’s because several red flags make it a risky investment.

Let’s explore each in detail.

Cerebras doesn’t have a lot of customers

To begin with, Cerebras counts the likes of AstraZeneca and GSK as customers.

But it generates more of its revenue from a single customer, “G42” which has a history of working with China. That customer based out of Abu Dhabi made up a whopping 87% of its revenue in the first six months of 2024.

So, Cerebras does claim that it will aggressively pursue opportunities in relevant sectors “where our AI acceleration capabilities can address critical computational bottlenecks.” But it has not been able to deliver on that promise so far.

“There’s too much hair on this deal. This would never have gotten through our underwriting committee,” as per David Golden, the former lead of tech investment banking at the largest US bank, JPMorgan Chase.

Big names are avoiding Cerebras

What’s also noteworthy is that Cerebras is not getting a lot of attention from the big players.

Barclays and Citi are serving as lead underwriters for its initial public offering. But neither of them historically dominates the tech IPO underwriting.

That crown sits with Goldman Sachs and Morgan Stanley instead – both of which are missing from the Cerebras deal.

Similarly, neither of the big four (KPMG, PwC, Ernst & Young, and Deloitte) have signed up as Cerebras’ auditor.

Could it be because Andrew Feldman – the chief executive of Cerebras pleaded guilty to circumventing accounting controls as the vice president of Riverstone Networks in 2007?

Whatever the reason may be, such big names choosing to remain on the sidelines may spell a huge red flag when it comes to investing in Cerebras IPO.

Finally, Cerebras is not yet a profitable company. In its latest reported quarter, it lost about $51 million which adds up to the list of reasons why I’d go into the “wait and see” mode and refrain from investing in the upcoming Cerebras IPO.

The post Here’s why I won’t invest in Nvidia competitor Cerebras’ IPO appeared first on Invezz