Xpeng’s flying car division, Xpeng AeroHT, has launched construction of a 180,000-square-metre manufacturing plant in Guangzhou, targeting the production of its newly unveiled modular flying car, the Land Aircraft Carrier (LAC).

Set for completion by 2026, this facility will have a capacity to manufacture up to 10,000 units annually.

After generating over 3,000 pre-orders since its September release, Xpeng is positioning its advanced transport innovation at the forefront of China’s modular flying car sector.

What is Xpeng’s Land Aircraft Carrier?

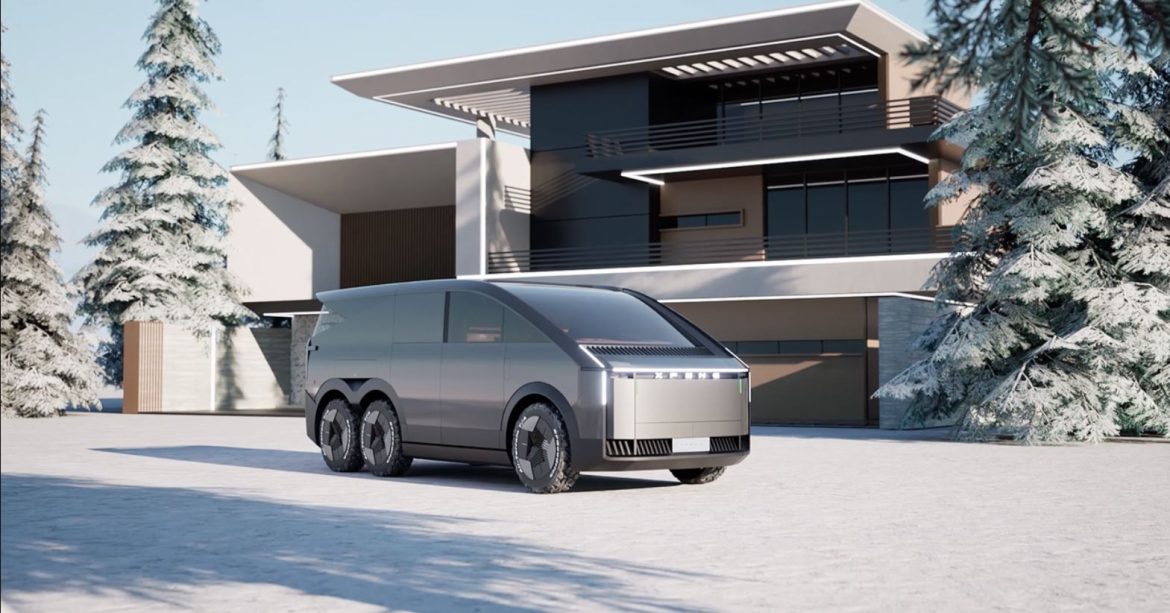

Introduced in September, Xpeng’s Land Aircraft Carrier, priced at approximately 2 million yuan, is a two-part vehicle with capabilities for both ground and air travel.

The LAC comprises a three-axle carrier and a large drone that can autonomously land and dock within the carrier.

Following its first public demonstration at the upcoming Zhuhai Air Show in November 2024, the vehicle’s modular design offers versatility for multiple applications, from emergency services to private transport.

While demand may be limited among individual buyers, Xpeng anticipates high interest from sectors like rescue and public services, where mobility is crucial.

Xpeng isn’t the only Chinese automaker entering the flying car space. Recently, Chery also unveiled its modular flying vehicle, highlighting the escalating interest in flying cars across China’s auto industry.

The potential of flying cars aligns with China’s ambition to lead in new transport solutions.

The development of supportive regulations for the safe, everyday use of these vehicles will likely influence broader adoption.

The LAC measures 5.5 meters in length, 2 meters in width, and 2 meters in height, featuring minimalistic, aerodynamic styling. Built on Xpeng’s 800V EREV platform, the carrier can reach a mixed range of 1,000 km per charge.

The aircraft component, an all-electric drone, can automatically dock with the carrier and is equipped to handle 5-6 flights on a full charge. Its high-voltage system enables the drone to recharge from 30% to 80% in just 18 minutes.

Xpeng’s new factory in Guangzhou

Xpeng’s new plant, located within the Guangzhou Development Zone, will house four production workshops, covering processes from assembly to painting.

Although construction was initially scheduled for September, the facility is now expected to be operational in time for Xpeng’s 2026 production targets.

The factory’s sole focus will be on manufacturing the aircraft component of the LAC, with the carrier assembly taking place at Xpeng’s existing facilities.

Despite early enthusiasm, the commercialization of flying cars faces regulatory and pricing challenges.

The high cost of the LAC, combined with China’s evolving legal framework for flying vehicles, may hinder mass-market adoption.

Furthermore, obtaining a flight license remains a requirement for commercial operation of these vehicles.

Yet, Xpeng’s focus on partnerships with institutional clients, including rescue services, could mitigate demand risks among private consumers.

The Land Aircraft Carrier’s success may redefine Xpeng’s standing in the global auto market.

Its venture into flying vehicles aligns with the rise of high-tech mobility solutions, which many expect to shape the future of urban and emergency transport.

As Xpeng pioneers flying car technology, the launch of its plant could signal further advancements, driving China’s leadership in advanced auto manufacturing.

The post Xpeng starts construction of new plant to produce 10,000 flying cars annually appeared first on Invezz