China’s lingerie industry, which has thrived under favorable trade policies, faces an uncertain future as the United States considers tightening the “de minimis” rule, according to a Reuters report.

This policy currently exempts foreign shipments valued under $800 from tariffs, allowing Chinese exporters to dominate the direct-to-consumer market.

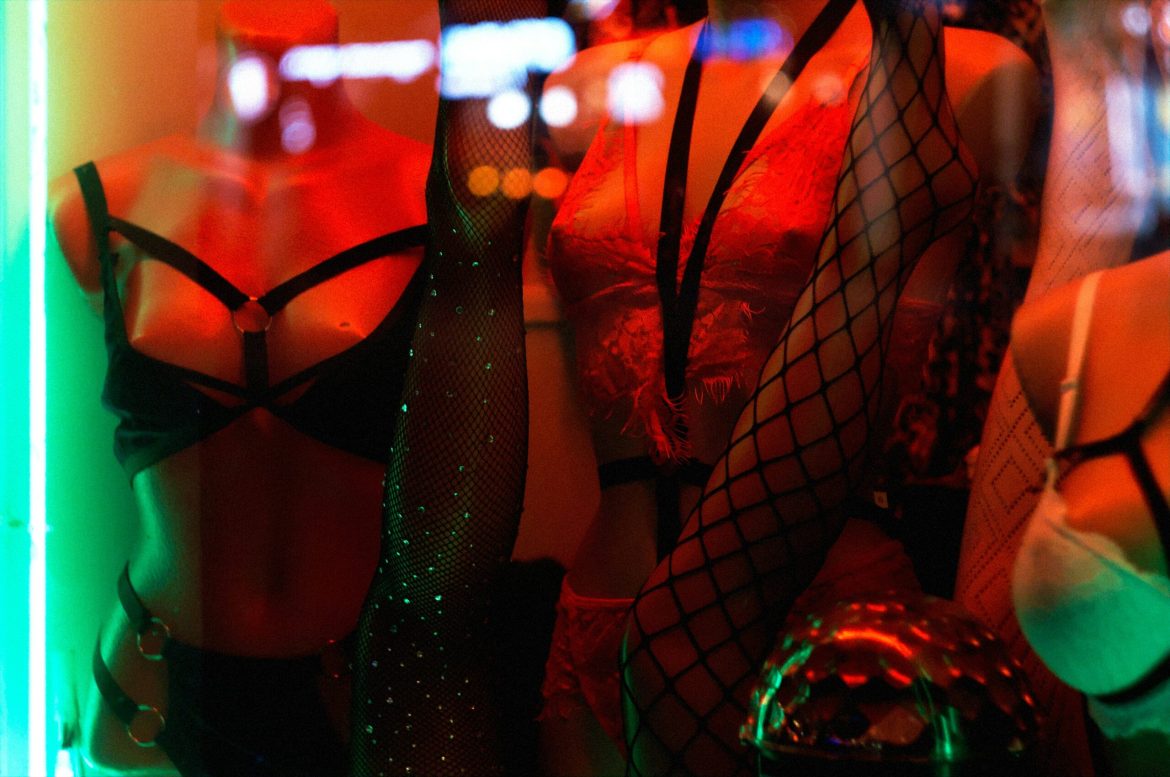

In Guanyun county, Jiangsu province, the local economy has been transformed by the rise of lingerie production, with over 1,400 firms employing 100,000 people.

Impending regulatory changes threaten to disrupt this lucrative trade, impacting revenues and livelihoods in a region heavily reliant on these exports.

US tariff changes to impact $240B in Chinese exports

The “de minimis” rule has been a cornerstone of China’s e-commerce growth, enabling platforms like Shein and Temu to ship products directly to US consumers at competitive prices.

In 2023, China is expected to export goods worth $240 billion under this exemption, contributing 1.3% to its GDP.

The Biden administration’s efforts to eliminate this policy, coupled with President-elect Donald Trump’s pledge to increase tariffs on China, are expected to slash export growth by 1.3 percentage points and GDP growth by 0.2 percentage points, according to Nomura.

For Guanyun, where lingerie accounts for 70% of Midnight Charm Garment Co.’s revenues, these changes pose a significant challenge.

Europe and Southeast Asia may follow suit

The United States is not alone in reconsidering the “de minimis” exemption.

The European Union and Southeast Asian countries are also exploring similar curbs, which could amplify the impact on China’s export-driven economy.

Apparel producers in Guanyun, who specialize in unbranded, low-value goods, are particularly vulnerable to these changes.

While some manufacturers are exploring alternative markets, the loss of the US as a primary buyer would create a ripple effect throughout the local economy.

Local government-backed industrial zones struggle

Victoria’s Secret Town, an industrial park in Guanyun, epitomizes the risks of overinvestment in state-backed projects.

With a $3 billion investment, local authorities aimed to create a hub for research, design, and logistics to support the lingerie industry.

Much of the park remains vacant, with no timeline for its full completion. Critics argue that such projects risk exacerbating deflationary pressures by creating excess manufacturing capacity.

Despite this, factory owners praise the park for its logistical advantages and support from local authorities, which includes industrial land, training programs, and funding for select firms. However, with global market dynamics shifting, the sustainability of this model is under scrutiny.

Manufacturers pivot to alternative markets

Faced with the threat of tariffs, manufacturers are exploring new strategies to mitigate losses.

Chinese producers are considering building warehouses in the US and adopting a bulk shipping model to reduce costs.

Many of the factory owners are also confident that demand from South America, the Middle East, and Central Asia can offset declining US sales.

For Guanyun’s one million residents, the lingerie industry has been a lifeline.

Average annual disposable income has risen to over 21,000 yuan in 2022, compared to just 5,000 yuan in 2008.

As the de minimis exemption comes under threat, the future of Guanyun’s economic prosperity hangs in the balance.

While diversification and adaptation may cushion the blow, the loss of a key export market would inevitably reshape the region’s economic landscape.

The post How China’s ‘erotic clothing’ hub is preparing for US de minimis rule changes appeared first on Invezz