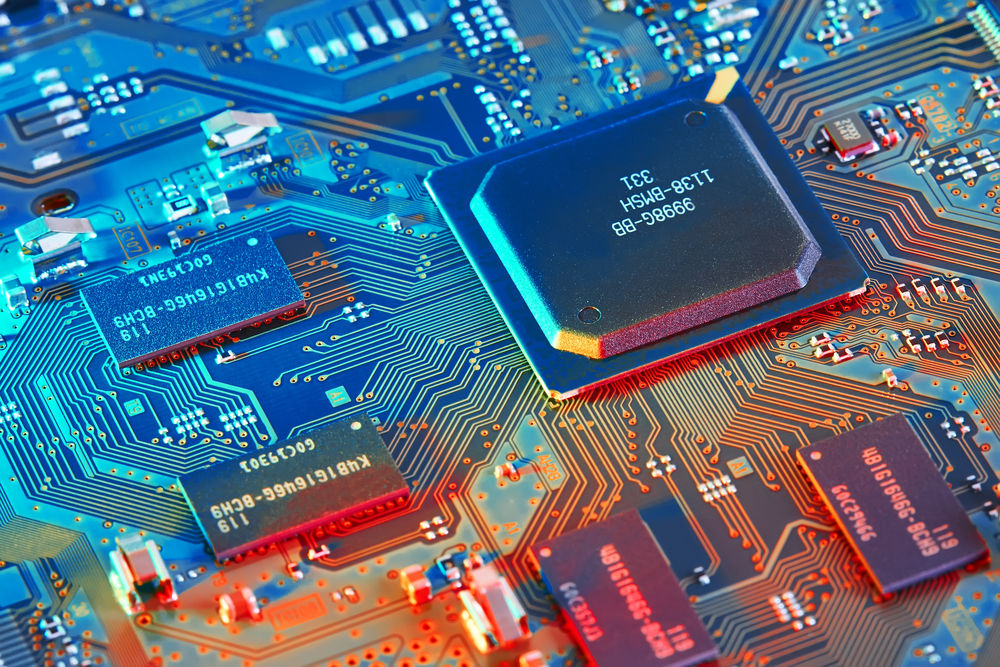

SemiAnalysis expert Myron Xie says Taiwan Semiconductor Manufacturing Co. Ltd. is “the only game in town for AI chips.”

TSMC is currently the leading and most reliable supplier of advanced artificial intelligence chips – and counts Nvidia as well as the hyperscalers committed to building their chips as customers.

This makes the New York-listed TSM stock one of the best buys to play the AI sector – perhaps even more so than Nvidia, according to Xie.

TSMC expects continued rapid growth in AI revenue

TSMC has a solid reputation in terms of quality and innovation. Its cutting-edge technology, particularly the 3nm and 5nm chips, is in high demand for AI applications.

Shares of the Taiwanese firm have already close to tripled since the start of 2024. Still, Myron Xie remains bullish on TSM stock for “its leadership in AI technologies.”

Taiwan Semiconductor ended last year with a whopping 200% increase in AI revenue.

But a slowdown is likely not in sight, considering the management expects the company’s AI business to grow by 40% annually over the next five years.

TSM shares currently pay a dividend yield of 1.15% which makes them all the more attractive to own for income investors.

Warren Buffett was once invested in TSM stock

The SemiAnalysis expert even sees TSMC coming in ahead of its bold forecast on AI revenue as its management is known to be conservative.

The NYSE-listed giant could, for example, see a sharper recovery in the smartphone space – which could result in an incremental further boost to its top line, he argued on CNBC’s “Capital Connection” on Friday.

Earlier this week, Taiwan Semiconductor guided for up to $25.8 billion in revenue for the first quarter of 2025 which translates to about a 37% increase on a year-over-year basis.

Note that the legendary investor Warren Buffett once dubbed TSMC one of the best-managed companies in the world. He, however, sold TSM stock due to geopolitical concerns in 2023.

TSMC is insulated from US chip export restrictions

The Biden administration has recently announced new regulations to limit the export of AI chips to select countries, including China.

Still, Myron Xie of SemiAnalysis is convinced the impact of such restrictions on TSMC’s revenue will likely be small as “there’s virtually little revenue associated with illegal schemes designed to get around these export controls.”

Late last year, Taiwan Semiconductor was reported focusing on accelerating its overseas expansion.

By the end of 2025, TSMC wants to set up 10 new factories, including one that is currently under construction.

Wall Street seems to agree with Xie as well.

Analysts currently have a consensus “buy” rating on TSM stock and see an upside in it to $246 on average which indicates potential for another 15% return over the next 12 months.

The post Top analyst reveals the best AI chip stock to buy in 2025—and it’s not Nvidia appeared first on Invezz