Plug Power stock price has crashed and is hovering near its all-time low as most new energy companies came under intense pressure. PLUG has dropped by over 8% this year and 58% in the last 12 months, bringing its market cap to over $1.69 billion. So, is it safe to buy the Plug Power stock dip?

Why Plug Power stock price has crashed

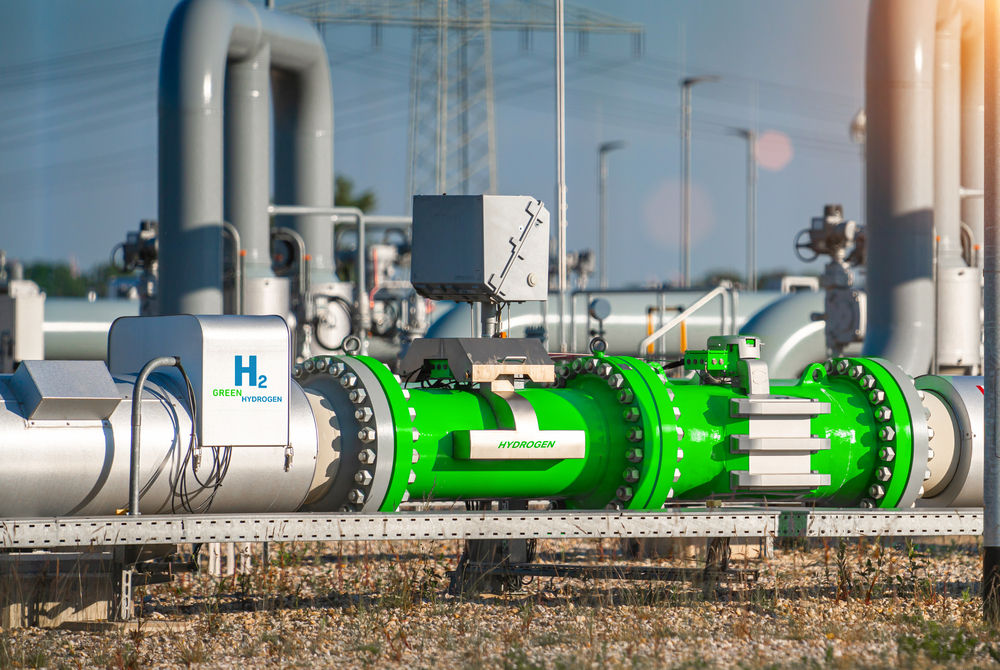

Plug Power is one of the biggest niche companies in the United States. It is a vertically integrated firm that manufactures hydrogen products, which analysts expect will continue doing well over time.

However, the industry has come under major headwinds this year. For example, Toyota, a top company that planned to dominate the hydrogen vehicle industry, has said that it will end passenger vehicle manufacturing amid weak demand.

The other notable development is that Nikola, another top hydrogen trucking company, is on the verge of bankruptcy. It has already sold some of its machinery to Mullen Automotive, a firm that may also collapse as soon as this year.

Further, Plug Power may go through a major challenge during the Donald Trump administration, which is expected to change its focus on renewable energy to fossil fuels. According to Bloomberg, the administration is considering cancelling a $400 billion program to finance clean energy projects.

Plug Power has been a key beneficiary of this program as it received $1.6 billion financing in January. It is not clear whether the Trump administration will want to cancel the project, considering that Plug Power hopes to use these funds to build up to six hydrogen plants in the country.

The government financing was an important part for the Plug Power stock as it ensures that it reduces dilution that has been going on for a while. Plug Power’s outstanding shares have risen from 306 million in 2020 to over 880 million today.

Read more: Plug Power stock is risky, but a short squeeze can’t be ruled out

Analysts are optimistic about PLUG growth

Another positive is that analysts are highly optimistic about Plug Power’s future, helped by the US’s hydrogen demand.

The most recent results showed that Plug Power revenue dropped to $173 million in the third quarter from $198 million in the same period a year earlier, Its nine-month revenue dropped to $437 million from $669 million a year earlier.

Most of Plug Power’s revenue still comes from the sale of equipment and related infrastructure. It hopes that the hydrogen fuel delivered to customers will continue doing well.

On the positive side, analysts are optimistic that the company’s business will continue doing well this year. The average revenue estimate for 2024 is $704 million, followed by $953 million this year. It will then cross the $1 billion in annual revenue in 2026.

At the same time, analysts anticipate that Plug Power’s business will make progress towards making profits. The loss per share will move from $1.8 in 2023, followed by $1.24 in 2024 and 62 cents in 2026.

Plug Power stock price forecast

The weekly chart shows that the PLUG share price has remained in a tight range in the past few months. It has moved downwards, forming a descending channel. The stock has remained below the 50-week moving average, while the MACD indicator has formed a bullish divergence and is about to make a bullish breakout.

The Relative Strength Index (RSI) has also made a series of higher highs, and higher lows, a positive sign of a bullish divergence. Therefore, while Plug Power stock is risky, a short squeeze cannot be ruled out. If this happens, the next point to watch will be at $4.9, its highest level in May last year, up by 130% from the current level.

The post Plug Power stock price has crashed: short squeeze may be epic appeared first on Invezz