Plug Power stock price has crashed to a record low, moving from a record high of $75.45 in January 2021 to $1. Its market cap has dropped from over $42.21 billion in 2021 to $960 million, meaning that investors have lost over $41 billion.

Why Plug Power stock price has crashed

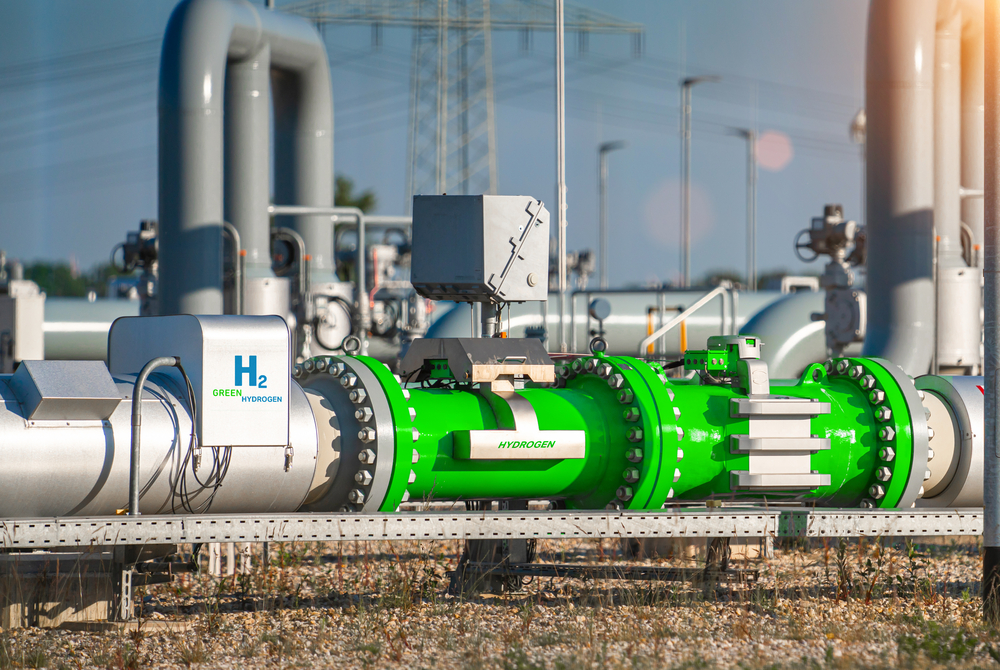

Plug Power share price has crashed in the past few years as concerns about the hydrogen energy industry remain.

Just recently, Nikola a company that built hydrogen trucks, filed for bankruptcy, a sign that the industry is in trouble.

Additionally, Toyota, one of the first automobile companies to build hydrogen vehicles, has also pulled back from the industry.

Therefore, there are concerns about whether the company will see more demand in the future since the auto sector is one of the most important consumers of liquid hydrogen.

The current use case for Plug Power’s business is in the material handling industry, e-mobility, and stationary power applications.

Plug Power stock price has also crashed after Donald Trump became the US president earlier this year. The concern among investors is that the Department of Government Efficiency (DOGE) may cancel its $1.66 billion financing by the Energy Department.

The Trump administration has focused on assessing funded projects to see whether they are of value to the US government. Still, there are chances that Plug Power will maintain these funds since the deal with the Energy Department (DoE) was signed in January.

Perennial cash burning machine

Plug Power stock price has also crashed because of its perennial cash burning. It has burned billions of dollars in the past few years.

The company had an operating cash flow of $1.3 billion in 2023 as it worked on its manufacturing plants.

Its cash outflow in 2024 stood at $797 million. The company’s outflow in the last five years stood at over $4 billion. Management expects that its cash burn will continue improving as its revenue rises and its cost cuts improve.

PLUG stock has also plunged because of its slow growth. Its annual revenue in 2024 stood at over $618 million, down from $880 million a year earlier.

Analysts expect that the company’s business will see higher sales this year. Analysts expect that its annual revenue this year will be $746 million, followed by $1.02 billion next year.

Plug Power stock price analysis

PLUG stock chart by TradingView

The daily chart shows that the PLUG share price has been in a strong bearish trend for a while as its cash burn has accelerated. It recently dropped below the crucial support at $1.60, the lowest swing in September last year.

Plug Power remains below the 50-day and 100-day Exponential Moving Averages (EMA). In trend analysis, that is a sign that bears are in control and that the downtrend will continue.

The Percentage Price Oscillator (PPO) has moved below the zero line, while the Relative Strength Index (RSI) has moved to the oversold level.

Therefore, the stock will likely continue falling as sellers target the key support at $0.50. The bearish outlook will become invalid if the stock rises above the key resistance point at $1.60, the lowest swing in September last year.

The post Plug Power stock price crashed from $75 to $1: what next? appeared first on Invezz