The US stock market bounced back on Tuesday after the truce between Iran and Israel. The Dow Jones, Nasdaq 100, and S&P 500 indices jumped by over 1%, and the bullish momentum continued in the futures market on Wednesday. This article conducts technical analysis and provides forecasts for top trending stocks like Plug Power (PLUG), Uber (UBER), and Pfizer (PFE).

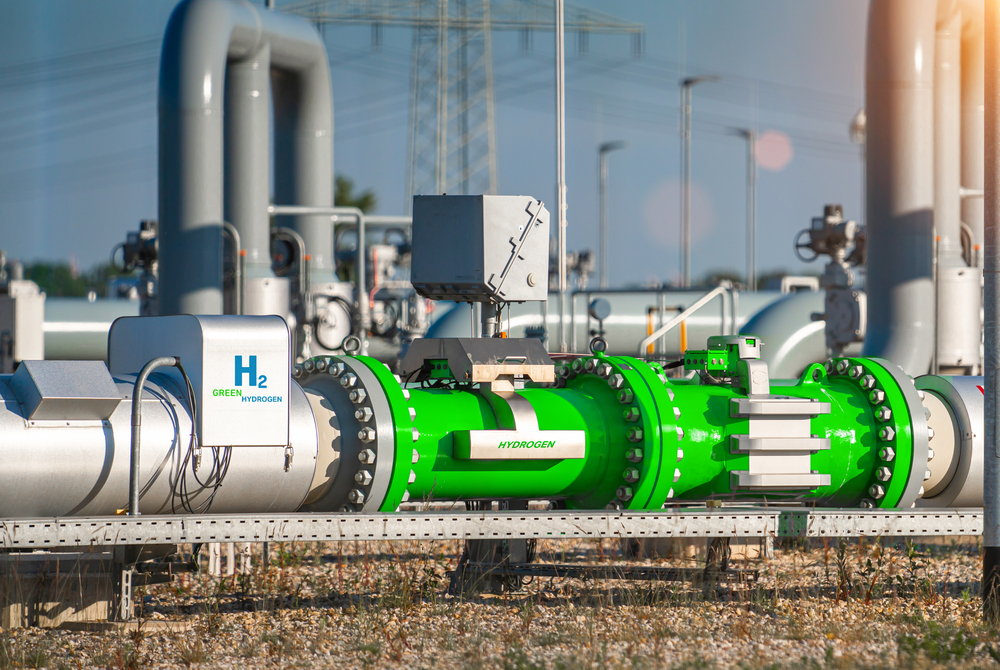

Plug Power stock price analysis

Plug Power, the biggest hydrogen-focused company in the United States, has been in the spotlight this year as traders watched the ongoing debate of the Big Beautiful Bill in Congress. This bill is notable for PLUG and other companies in the clean energy industry because it ends some of Biden’s mandates.

The daily chart shows that the PLUG stock price bottomed at $0.70 in May and then bounced back to a high of $1.53. It has now pulled back and moved to slightly above the support at $1.

PLUG share price has formed a bullish flag pattern, a popular continuation sign in technical analysis. This pattern comprises of a vertical line and a descending channel or a consolidation.

PLUG stock price remains slightly above the 50-day and 25-day moving averages, a highly bullish sign. Therefore, the combination of a falling wedge and a bullish flag pattern points to more gains, potentially to this month’s high of $1.53, which is about 33% above the current level.

Read more: Insiders are buying Plug Power stock: is a short-squeeze coming?

Uber stock price analysis

Uber, the giant ride-hailing company, surged on Tuesday as investors cheered the launch of its robotaxi service in Atlanta through its collaboration with Waymo. The launch happened as Tesla has started promoting its robotaxi solution, which it hopes will be a big competitor in the industry.

The daily chart shows that the Uber stock price bottomed at $54.86 in August last year and then bounced back to the current $92.5, a 65% surge. It recently jumped above the key support level at $82, the highest swing in February.

Uber is nearing the important resistance level at $93.35, its highest point on May 20th. It has remained above the 50-day and 100-day moving averages, a sign that bulls are in control.

Uber now needs to jump above the resistance level at $93.36 to invalidate the double-top pattern. A double-top is one of the riskiest chart patterns in technical analysis.

A move above the resistance at $93.36 will point to more gains towards the resistance at $100. A drop below the support at $87.50 will invalidate the bullish Uber stock forecast.

Read more: Waymo vs Tesla’s Robotaxi: Alphabet’s quiet driverless surge is overlooked

Pfizer stock price forecast

Pfizer, the giant pharmaceutical company, has jumped in the past few months, moving from a low of $20.54 in April to $24.3 today. PFE stock has moved above the 50-day and 25-day moving averages, forming a bullish crossover pattern.

Pfizer stock has also formed a rising wedge pattern, comprising of two ascending and converging trendlines. This pattern often leads to a strong bearish breakdown, which, in this case, may drop to $22. A move above the resistance level at $25 will invalidate the bullish Pfizer stock forecast.

The post Top stock price forecast: Plug Power, Uber, and Pfizer appeared first on Invezz