The Minerals Council of South Africa has stated that the proposed chrome ore export tax will negatively impact the profitability of miners and result in job losses throughout the sector, according to a Reuters report.

South Africa stands out as Africa’s most advanced economy, and it holds a dominant position in the global market as the leading exporter of chrome.

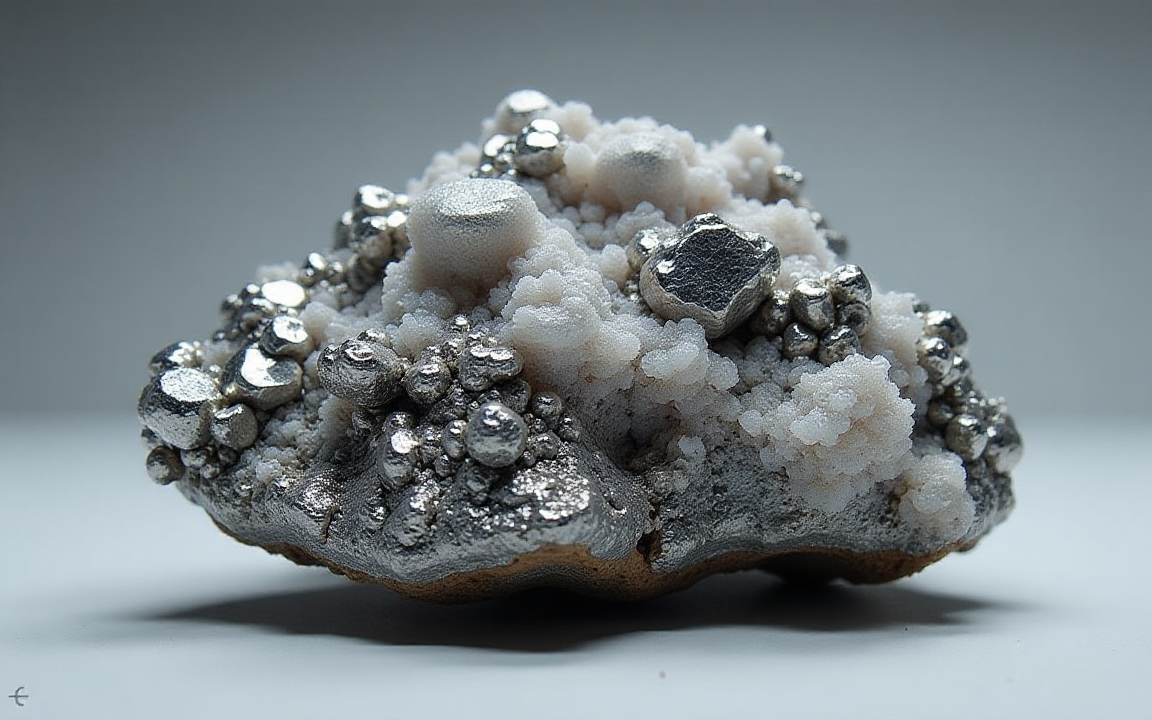

Chrome is a critical raw material primarily utilised in the production of stainless steel, a versatile alloy known for its corrosion resistance and strength.

This significant role in the chrome supply chain underscores South Africa’s importance to various industrial sectors worldwide, particularly those involved in manufacturing, construction, and infrastructure development.

The nation’s abundant natural resources and established mining industry have enabled it to capitalise on this valuable commodity, contributing substantially to its economic output and international trade relations.

Also, South Africa, once the leading global producer of ferrochrome, a crucial alloy of chrome and iron, has seen its dominance wane significantly.

This decline is largely attributable to the country’s escalating electricity costs, which have rendered the operation of many ferrochrome smelters economically unviable.

High electricity prices impact profitability

The energy-intensive nature of ferrochrome production means that high electricity prices directly impact profitability, forcing numerous smelters to either reduce output or cease operations altogether.

As a result, China has surpassed South Africa to claim the top spot in global ferrochrome production.

China benefits from more competitive energy prices and a robust industrial infrastructure, allowing it to produce ferrochrome at a lower cost.

This shift highlights the critical role of affordable and reliable energy in maintaining a country’s competitiveness in energy-intensive industries.

For South Africa, addressing its electricity crisis is paramount to regaining its position in the ferrochrome market and fostering industrial growth.

South Africa’s cabinet announced on June 26 its agreement to two key measures aimed at halting the ferrochrome industry’s decline: lower power tariffs for chrome smelters and a proposed tax on chrome ore exports.

In a statement, the Minerals Council South Africa, representing the nation’s largest mining companies, asserted that the proposed tax “would not achieve the government’s aims of sustaining the ferrochrome industry and the preservation of jobs.”

Instead, it would negatively impact chrome producers, their significant contribution to South Africa’s economy, and the jobs they sustain and grow.

Economical importance

South Africa’s chrome industry plays a pivotal role in the nation’s economy, serving as a significant source of employment and export revenue.

In 2024, the sector directly provided livelihoods for 25,000 individuals, underscoring its substantial contribution to job creation.

Beyond employment, chrome exports generated a remarkable 85 billion rand, equivalent to approximately $4.85 billion, in revenue for the country.

This financial input is crucial for South Africa’s balance of trade and national development.

In 2024, a record 20.5 million metric tons of chrome concentrate were exported, primarily to China, the world’s leading importer of this commodity.

In South Africa, several companies are involved in the mining and processing of chrome. These include Glencore, Tharisa Plc, and South32.

The post South Africa chrome export tax sparks debate as miners warn of negative impact appeared first on Invezz