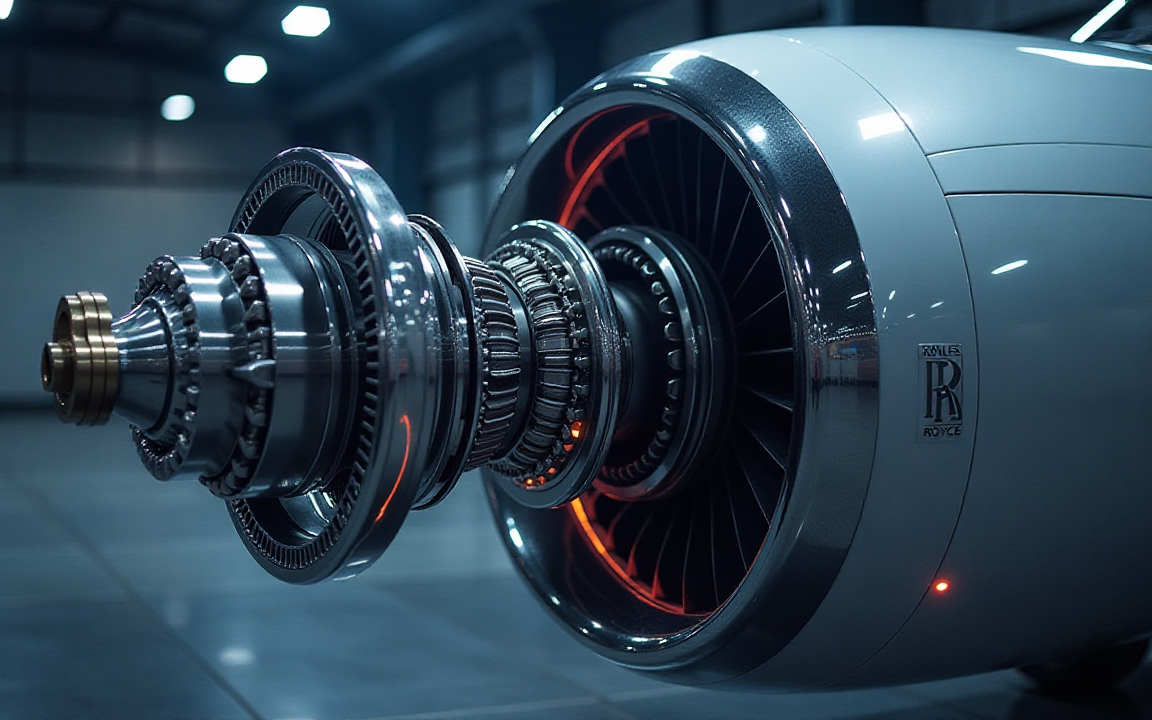

Rolls-Royce share price has been in a relentless bull run in the past few years, helped by the robust demand for its services and products in the civil aviation, defense, and power sectors.

RR stock has also surged as management’s efforts to boost sales and reduce spending have been successful. All this has helped it to start returning money to investors through dividends and share buybacks.

Rolls-Royce shares were trading at 1,067p on Monday, a few points below this month’s high of 1,103. It has jumped by 2,705% from its lowest level in 2020, bringing its market capitalization to over $121 billion.

Reasons for the Rolls-Royce share price surge

The ongoing Rolls-Royce share price happened as the civil aviation segment boomed after the pandemic halt. Wide-body engine demand has soared, with the supply chain issues being the only hindrance.

At the same time, the return to flying has boosted its services revenue, which is its most important segment. While RR is known for manufacturing engines, it makes most of its money from the long-term service contracts to its customers.

Rolls-Royce stock has boomed as the defence industry has boomed amid the ongoing geopolitical tensions. There is also an ongoing drive by European countries to prop up their defense industrial base as the US becomes unreliable.

RR is also benefiting from the ongoing tailwinds of artificial intelligence that have led to an unprecedented demand for power from data centers. This is notable since Rolls-Royce is a major manufacturer of power equipment and nuclear power engines.

Read more: Takeaway of Rolls-Royce earnings and impact on its share price

Is RR a bargain or overvalued?

The ongoing Rolls-Royce share price has boosted its valuation substantially such that it is now one of the biggest British companies.

The most recent results showed that its half-year revenue jumped to £9 billion from £8.1 billion in the same period a year earlier. Its underlying profit rose to £1.7 billion, while it margin rose to 19.1%.

Rolls-Royce’s profit before tax and free cash flow were £1.68 billion and £1.52 billion. The management also boosted its forward guidance such that it now expects that the operating profit and FCF will be £3.2 billion and £3.1 billion, respectively.

Therefore, dividing the two numbers with the market cap of £89 billion gives it an approximate price-to-operating profit and PCF multiples of about 27. However, the forward price-to-earnings ratio of 47 is quite expensive for the company.

A discounted free cash flow (FCF) metric by Grok identifies the ideal fair value at 618p per share. A similar calculation by Simply Wall Street identifies its fair value at 1080p, which is about 0.80% above the current level.

Rolls-Royce share price analysis

The weekly chart shows that the Rolls-Royce stock price has been in a relentless bull run in the past few years and is now trading at its all-time high.

There is a risk that this bull run could be about to end for two main reasons. First, the Relative Strength Index (RSI) and the Stochastic Oscillator have moved to the overbought level. A highly overbought asset is always at risk of a bearish reversal.

Second, the stock rises much higher than the moving averages. It is much higher than the 50-week moving average at 743p and the 100-week average at 584p. Therefore, there is a risk that it will go through mean reversion, where an asset drops so that it can approach the historical averages. If this happens, it may drop to about 800p by the end of the year.

The post Is the expensive Rolls-Royce share price at risk of mean reversion? appeared first on Invezz