Rolls-Royce share price has surged this year and is hovering near its all-time high as demand for its engines continues rising. It rose to 1,090p on Monday, a few points below the year-to-date high of 1,110p. It has also jumped by 96% from its lowest level in April.

From a burning platform to a cash printer

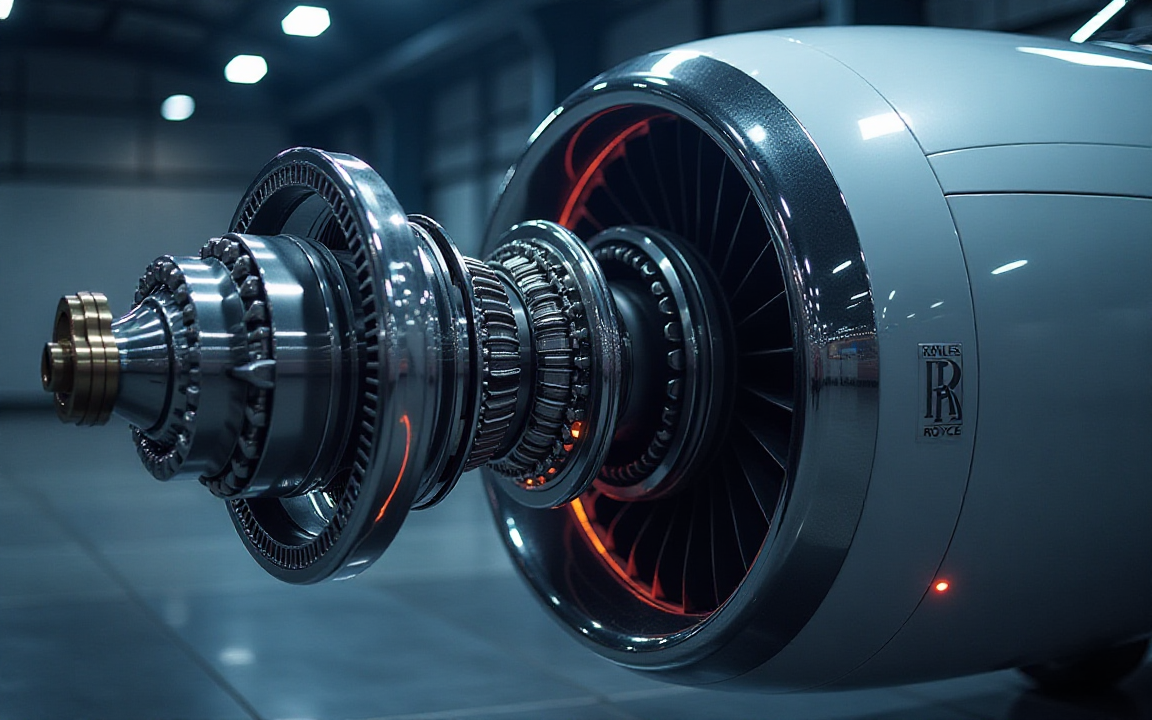

Rolls-Royce Holdings has transitioned from what its CEO called a “burning platform” into a cash printer, thanks to its strong revenue and demand growth across all industries, including civil aviation, defense, and power.

The company has mostly benefited from the ongoing civil aviation boom that has made many airlines highly profitable. For example, United Airlines revenue rose to $57 billion last year from $50.5 billion in the previous year.

Delta Air Line’s revenue also jumped to $61 billion, while in Europe, companies like IAG and Lufthansa are also thriving.

This growth has helped its business thrive as it makes most of its revenue and profits in the civil aviation. It generates this revenue from selling engines and entering into long-term service contracts with airlines.

The company has also benefited from the ongoing artificial intelligence (AI) boom that has led to more demand in data center energy. Many data center companies now use some of its power engines.

Nuclear power tailwinds

Most importantly, the company’s nuclear power business is also thriving after it won a deal with the UK government to build small nuclear reactors. Just recently, Sweden said that it was considering building several small nuclear reactors with British technologies.

With its strong background in the nuclear space, there is a likelihood that this division would be worth billions of dollars.

For example, Oklo, an American company building similar solutions, has achieved a market capitalization of $10 billion. NuScale, another top company in the industry, has a $9.2 billion. The two companies are yet to start making a profit.

Rolls-Royce is now a giant money printer with its free cash flow rising to £1.5 billion in the year’s first half from £1.15 billion in the same period last year.

Analysts anticipate that its free cash flow will continue growing in the coming years. It will get to £3.3 billion in the next financial year, followed by £3.9 billion and £4.4 billion in the next two years.

If the trend continues, the company may beat these targets sooner than expected. For example, it recently beat its mid-term targets two years in advance. This FCF growth has helped it start buying back its stock and boosting its dividend.

Rolls-Royce share price technical analysis

The daily timeframe chart shows that the RR stock price has been in a strong bull run in the past few years. Recently, however, it has found a resistance level at 1,103p, a level it has failed to move above several times.

The stock has formed a double-top pattern, while the MACD and the Relative Strength Index (RSI) have formed a bearish divergence. Therefore, RR stock price will likely have a pullback in the coming weeks. If this happens, the next point to watch will be at 1,000p.

The post Rolls-Royce share price: what next for the former ‘burning platform?’ appeared first on Invezz