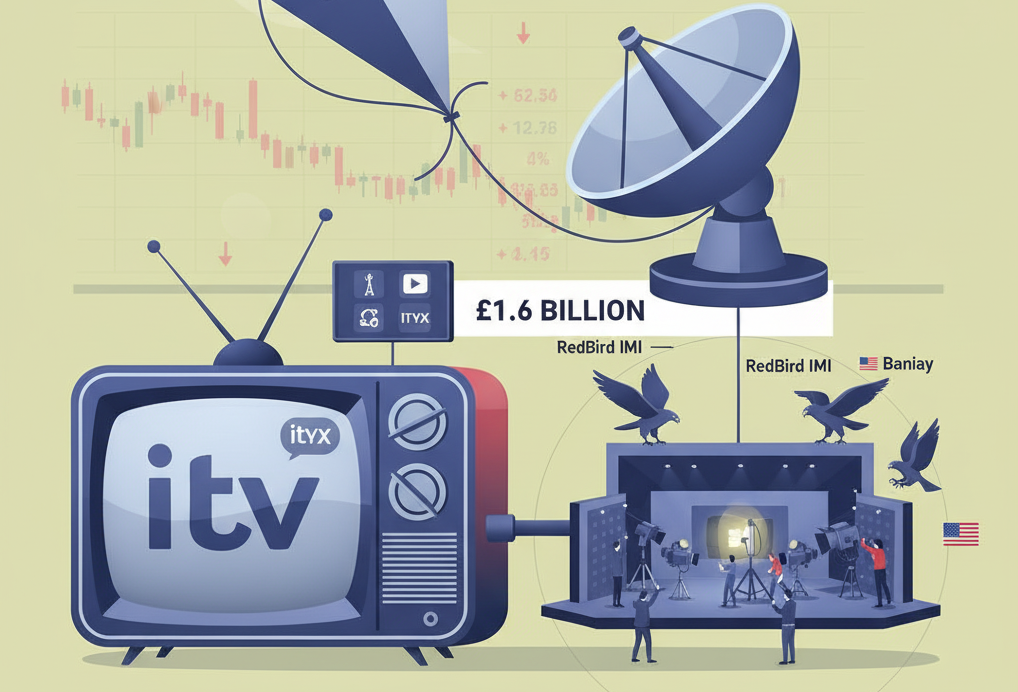

ITV said on Friday it is in advanced discussions with Sky, the British pay-TV giant owned by Comcast, over a potential £1.6 billion ($2.15 billion) sale of its media and entertainment (M&E) division, including debt, marking one of the biggest shake-ups in UK broadcasting in years.

Financial Times reported that any transaction would not involve ITV Studios, the broadcaster’s production arm.

The deal would focus solely on the broadcaster’s advertising-dependent M&E operations.

The M&E unit encompasses ITV’s free-to-air television channels and its ITVX streaming platform.

The division generated £955 million ($1.28 billion) in revenue and £35 million in adjusted earnings before interest, tax, and amortisation during the first half of 2025, according to figures released in July.

The unit has faced mounting challenges from a weakening ad market and rising competition from global streaming players.

How would Sky benefit from ITV’s assets?

Comcast, which acquired Sky in 2018, is reportedly one of several companies to have expressed interest in ITV’s assets as traditional media groups continue consolidating to defend market share against digital rivals such as Netflix and Amazon Prime Video.

For Sky, acquiring ITV’s broadcast operations would expand its reach in free-to-air television and bolster its advertising footprint across the UK and Europe.

While discussions are ongoing, sources told the Financial Times that ITV Studios would not form part of any agreement.

The studios division — known for global hits such as Love Island and Line of Duty — has become a core revenue driver, producing shows for both ITV’s own networks and other broadcasters worldwide.

Analysts have suggested that the studio’s business alone could be worth as much or more than ITV’s entire current market capitalisation of £2.5 billion.

ITV’s studios arm courts dealmaking interest

ITV’s studios arm has attracted interest from rival TV production companies and private equity groups.

The most developed proposal came from RedBird IMI — a partnership between US private equity firm RedBird and an Abu Dhabi state-backed investor — but the talks were abandoned earlier this year.

French production giant Banijay also weighed a potential bid for either ITV’s studios arm or the entire group, as per reports, though its interest has since waned.

ITV shares have been under pressure

ITV’s shares have declined in recent weeks, partly after US media and telecoms group Liberty Global — the broadcaster’s largest shareholder — cut its stake by half.

Liberty, chaired by veteran cable executive John Malone, had held around 10% of ITV since 2015 and was long viewed as a potential suitor or key player in any future takeover bid.

On Thursday, the company cautioned that its advertising revenue would fall 9% year-on-year in the final quarter, citing economic uncertainty following Chancellor Rachel Reeves’ upcoming budget announcement on November 26.

Chief executive Carolyn McCall has been under growing pressure to unlock shareholder value, with a strategic split of ITV’s businesses among the options considered.

Advisers from Robey Warshaw and Morgan Stanley are assisting in evaluating the company’s options.

Analysts say a sale of the M&E arm could streamline ITV’s structure and highlight the value of its global studios division, potentially positioning it for a stronger rerating on the London Stock Exchange

The post ITV in talks to sell media and entertainment arm to Sky for £1.6B appeared first on Invezz