The FTSE 100 Index held steady near its all-time high as the Bank of England delivered its interest rate decision and as several important companies like BT, National Grid, and AstraZeneca published their financial results. It has jumped by 29% from its lowest level in April.

FTSE 100 Index steady after BoE decision

The FTSE 100 Index, which tracks the biggest companies in the UK, published its interest rate decision that was in line with expectations.

It left interest rates unchanged at 4% as officials remained concerned about inflation, which has moved in the opposite direction in the past few months. The most recent report showed that the UK inflation rose is to 3.8% in September, much higher than the bank’s target of 2.0%.

In its statement, the bank predicted that inflation will come downwards in the coming years, reaching its 2% target in 2027. In contrast, the European Union’s inflation is hovering around the 2% target in the past few months.

Still, analysts believe that the bank will consider cutting rates in December despite the immediate inflation risks.

The FTSE 100 Index also reacted to a statement by Rachel Reeves, the Chancellor. In it, she hinted that her upcoming budget will have some tax hikes, as she tries to fill her budget hole.

Meanwhile, some major FTSE constituent companies published mixed financial results this week. BT Group’s results showed that its slow down continued, pushing the company to accelerate its layoff process.

Other companies that published their results this week were companies like AstraZeneca, National Grid, Auto Trader, and IAG, the parent company of British Airways and Aer Lingus.

Top Footsie companies to watch

The FTSE 100 Index will be in the spotlight as some key companies publish their results and trading statements next week.

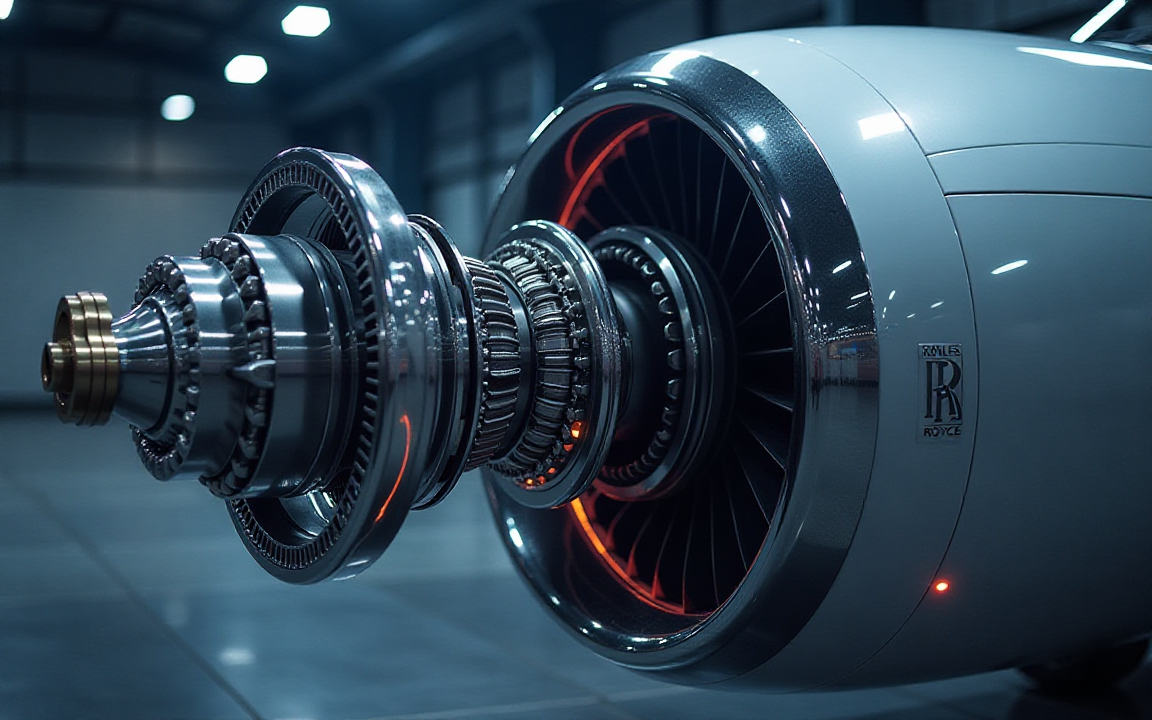

Rolls-Royce Holdings will be one of the top companies that will publish its trading statement next week. Its statement will be watched closely because its stock has been in a strong uptrend in the past few years, helped by its civil aviation, defense, and power businesses.

Analysts expect that the company’s forward guidance will be strong as evidenced by the recent strong results by top companies in Europe, Asia, and Europe.

The other notable FTSE 100 Index stock to watch will be Vodafone, the giant telecom company, which will publish its results on Monday. Its most recent results showed that its revenue rose by 3% in the first quarter to 9.4 billion euros, with its service revenue rising by 5.3% to 7.9 billion euros.

This revenue growth was driven by its Three acquisition, which helped to offset the 3% decline in its core market of Germany, where it struggled because of a TV law change.

3i Group will be another top FTSE 100 Index company to watch as it releases its numbers. 3i is a top investor that owns companies like Audley Travel, BoConcept, Constellation, and Christ. It will publish its numbers on November 12.

The other top FTSE 100 stocks to watch will be Endeavor Mining, Burberry, United Utilities, Intermediate Capital Group, and SSE.

FTSE 100 Index technical analysis

The daily timeframe chart shows that the FTSE 100 Index has been in a strong uptrend in the past few months, moving from a low of £7,545 in April to £9,800 today.

It has already moved above the important resistance level at £9,000 and the £8,900, its highest level since March this year.

It has remained above the 50-day and 100-day Exponential Moving Averages (EMA)and the Ichimoku cloud indicator.

The most likely scenario is where it continues rising in the coming weeks. If this happens, it will likely hit the important resistance level at £10,000.

The post FTSE 100 Index shares to watch: Rolls-Royce, Burberry, Vodafone appeared first on Invezz