Nvidia Corp. Chief Executive Officer Jensen Huang said on Saturday that he has asked Taiwan Semiconductor Manufacturing Co. (TSMC) for additional chip supplies as demand for artificial intelligence (AI) technologies continues to grow rapidly.

Speaking to reporters in Hsinchu, Taiwan, where he attended TSMC’s annual sports day, Huang described Nvidia’s business as “very strong” and strengthening further each month.

Huang seeks more wafers amid soaring AI demand

Huang said Nvidia’s AI business continues to expand at an exceptional pace, with demand showing no signs of slowing.

“The business is very strong, and it’s growing month by month, stronger and stronger,” he said.

Nvidia relies heavily on TSMC to manufacture its advanced chips that power AI data centers, training clusters, and cloud computing systems used worldwide.

The Nvidia chief also noted that the company’s three main suppliers of AI memory chips — SK Hynix Inc., Samsung Electronics Co., and Micron Technology Inc, have all scaled up “tremendous capacity” to meet the growing demand for Nvidia’s hardware.

These suppliers are key partners in producing the high-bandwidth memory critical to Nvidia’s latest generation of AI accelerators.

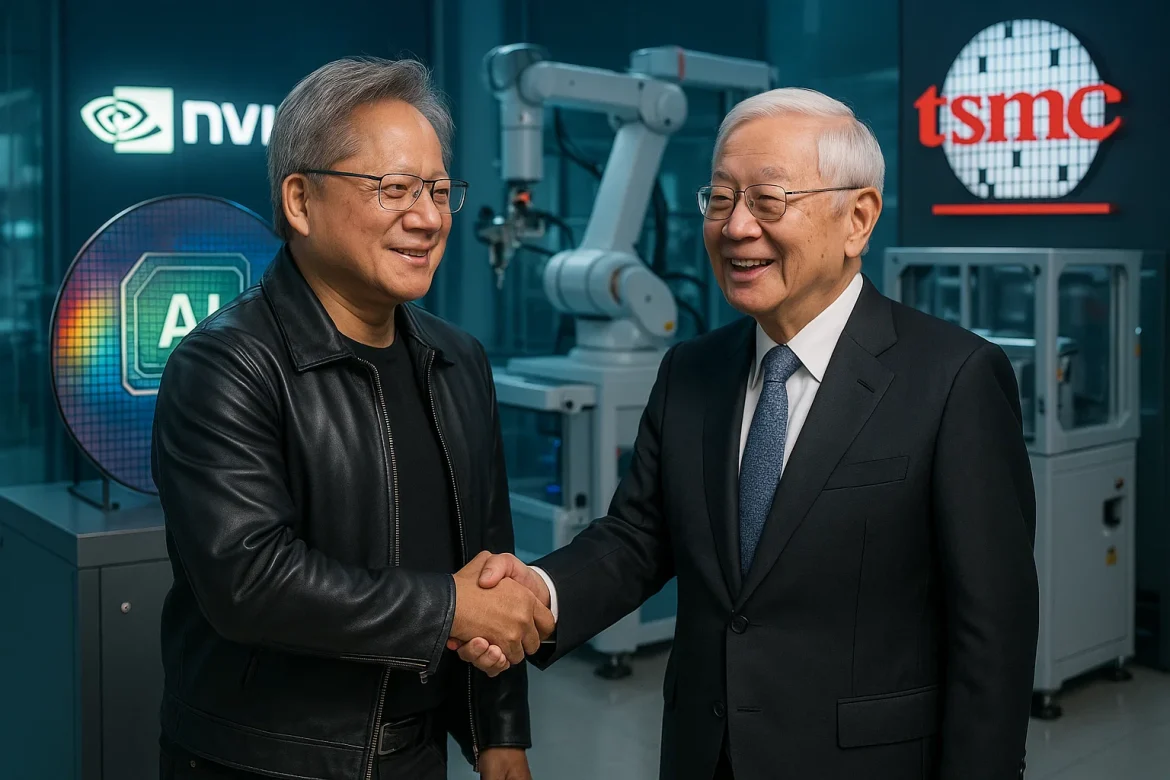

During the same event, TSMC CEO C.C. Wei confirmed that Huang had personally requested more wafers during their meeting.

Wei told employees that TSMC expects to continue setting record sales each year, underscoring the robust demand for advanced semiconductors driven by AI-related applications.

Market sentiment cools despite Nvidia’s strength

Huang’s comments came at the end of a volatile week for megacap technology stocks, as investor enthusiasm around AI took a brief pause.

The sector saw sharp declines after skepticism resurfaced regarding the sustainability of AI-driven valuations.

Concerns over OpenAI’s funding and new bearish positions on Nvidia by Michael Burry’s Scion Asset Management weighed on sentiment.

Despite the market turbulence, Nvidia remains the world’s most valuable company, surpassing Apple Inc. and Microsoft Corp. in market capitalization earlier this year.

The company’s dominance in the AI chip market, particularly through its H100 and upcoming B100 processors, continues to underpin investor confidence in its long-term growth prospects.

Huang’s optimism is shared by other technology leaders.

Qualcomm Inc. CEO Cristiano Amon told Bloomberg earlier in the week that the world is still underestimating the potential scale of AI technology.

Strengthening the TSMC partnership

Huang’s appearance in Taiwan highlights the strategic importance of Nvidia’s partnership with TSMC.

The two companies maintain a close working relationship, with TSMC fabricating Nvidia’s most advanced chips on its leading-edge process nodes.

On Friday, Huang and Wei met for a private dinner, where they reportedly discussed ways to strengthen cooperation.

Huang publicly expressed gratitude toward TSMC for its pivotal role in Nvidia’s rise to global prominence, saying, “No TSMC, no Nvidia.”

Wei reiterated that TSMC’s manufacturing capacity remains “very tight,” noting that the company continues working to close the gap between rising demand and limited supply.

With AI demand accelerating globally, both companies appear committed to deepening collaboration to maintain leadership in the fast-evolving semiconductor landscape.

The post Nvidia CEO Jensen Huang seeks more chip supply from TSMC as AI demand surges appeared first on Invezz