Australia’s iron ore sector gained fresh momentum in October as shipments from Port Hedland reached their highest level for that month in records going back to 2010.

The rise highlights how China’s consistent buying continues to support Australia’s trade performance during a year of uneven global demand.

The strength in iron ore flows is shaping expectations for how the country’s mining industry will navigate changing supply conditions and renewed competition in the seaborne market.

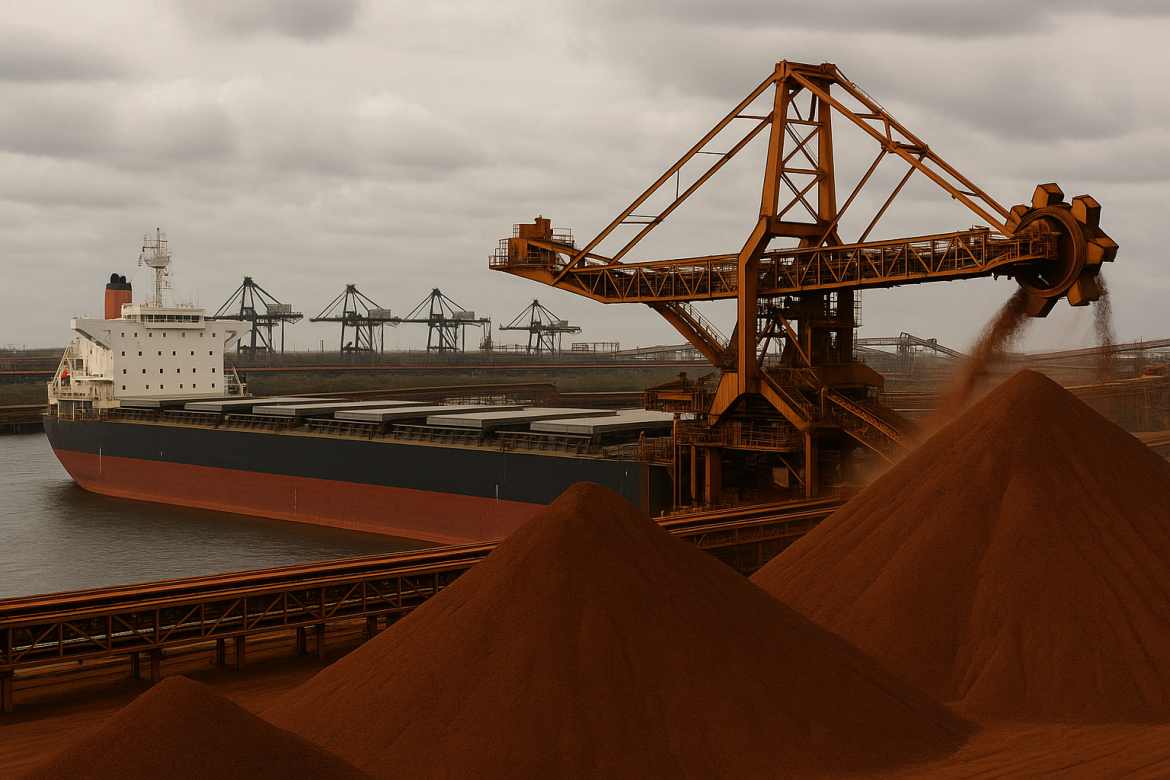

According to data from the Pilbara Ports Authority and Bloomberg, Port Hedland handled 49.5 million tons of iron ore in October.

This was nearly 8% higher than the same month in 2024 and marked a new seasonal record.

Shipments from the port have now reached about 476 million tons so far this year, putting Australia slightly ahead of its pace at the same point in 2024.

China’s influence grows

Most of the material leaving Port Hedland continues to move to China, which remains Australia’s most important destination for iron ore.

Chinese customs data show that the country imported about 7% more iron ore in October than a year earlier.

The increase indicates that mills and traders in Asia’s largest economy are still drawing in large volumes of raw materials despite a prolonged property downturn and weaker steel production.

This steady pull from China has helped Australia maintain stable export flows even as other sectors of the global economy face pressure.

The demand has also supported the mining industry during a period when construction activity in China has slowed, yet stockpiling and industrial operations have required consistent supplies.

The October data reinforce how critical Chinese buyers remain for Australia’s resource sector.

Global supply shifts

The outlook for export volumes suggests further growth in the next couple of years.

An Australian government report indicates that steelmaking material volume exports are expected to increase.

However, the report also notes that prices may come under pressure as new supply enters the market from Africa.

The additional tonnage from emerging producers is likely to increase competition across key Asian markets.

Port Hedland’s performance offers insight into how these changes may influence Australia’s position in the global trade system.

The port serves major miners including BHP Group and Fortescue Ltd, making its throughput a useful indicator of broader trends.

The record level of October shipments suggests that Australia remains well placed to supply Asia even as new competitors work to establish a presence.

Role in national flows

Port Hedland’s prominence continues to shape national iron ore statistics.

Its large share of exports means that shifts in activity there can have an immediate impact on Australia’s overall trade results.

With shipments reaching new seasonal highs and China continuing to absorb most of the volumes, the port remains central to the resilience of Australia’s resource economy.

The latest data confirm that Australia’s mining supply chain is still benefiting from long-term demand from China.

The post Iron ore shipments surge as China drives Australia’s trade appeared first on Invezz