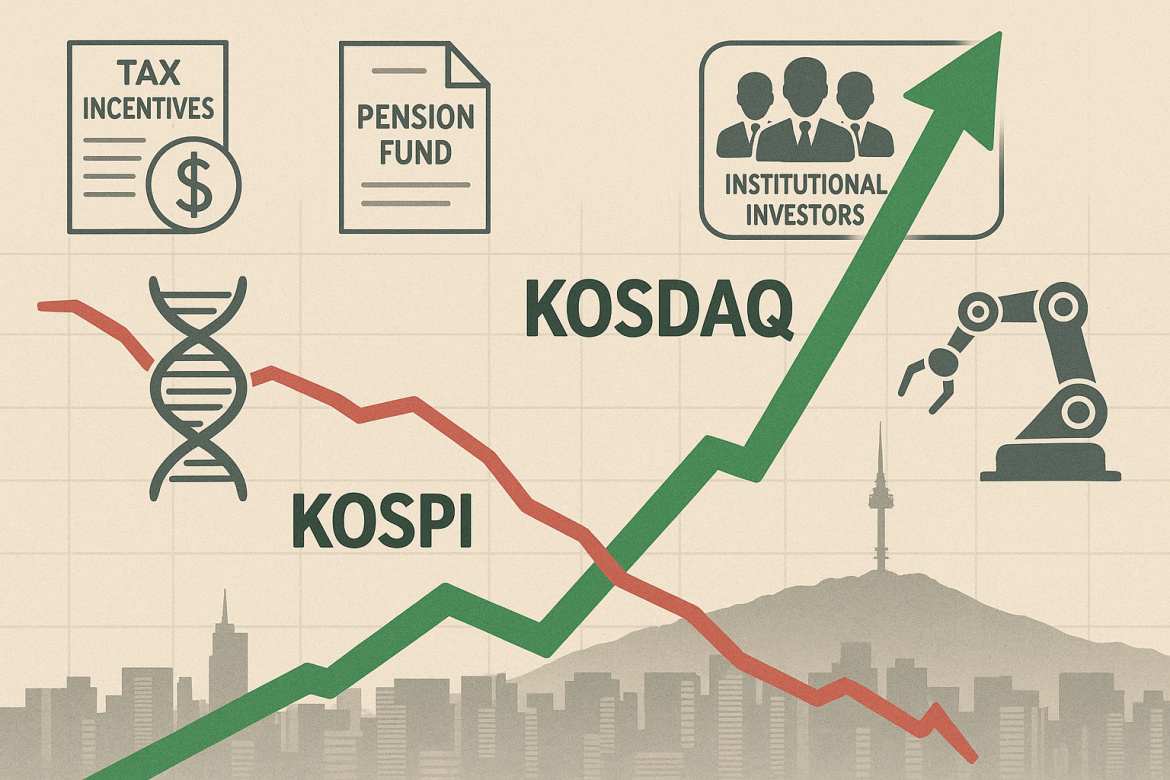

South Korea’s small-cap Kosdaq Index surged sharply on Friday following media reports suggesting that the government may introduce tax incentives and encourage greater stock market participation by institutional investors.

The rally, driven by renewed optimism ahead of expected policy measures, saw the Kosdaq outperform the nation’s benchmark Kospi Index by the widest margin in more than four years.

Kosdaq outperforms Kospi in a marked shift

The Kosdaq rose as much as 3.4% during intraday trading, in stark contrast to the Kospi, which fell 1.5% on the day.

According to Bloomberg, this marked the index’s strongest single-session outperformance relative to the Kospi since March 2020.

The move added momentum to what has already been a robust year for South Korean equities.

The Kospi has climbed nearly 63% in 2025, putting it among the world’s top-performing major indexes.

The smaller, retail-heavy Kosdaq has lagged behind but still posted an impressive 34% gain year-to-date.

Analysts note that while the Kospi has benefited from large-cap momentum and corporate migration toward the benchmark, the Kosdaq has struggled with instability among retail investors, who dominate trading volumes and have shown heightened sensitivity to market uncertainty.

Government policy expectations fuel buying momentum

Investor enthusiasm intensified after the Korea Economic Daily reported that the government may introduce market-friendly measures as early as next month.

Among the proposals under discussion are expanded income tax deductions for Kosdaq venture funds that allocate a significant share of capital to index-listed small caps.

The government is also reportedly considering exemptions on stock trading taxes for pension funds and foreign institutional investors.

While the Financial Services Commission said that no final decisions had been made, it confirmed that it is still reviewing approaches to support capital markets.

The policy speculation was enough to ignite strong inflows into Kosdaq-listed companies, particularly within biotechnology and robotics – two sectors historically sensitive to stimulus expectations.

Peptron Inc., a pharmaceutical firm, was among the standout performers, climbing more than 15% during the session.

Broader gains across growth-oriented industries echoed past rallies fueled by expectations of regulatory support and funding expansion.

Shawn Oh, head of Korea cash equities at NH Investment & Securities, said in a Bloomberg report that the report has been “making some buzz this morning.”

He added that the latest measures appear intended to help the Kosdaq approach the 1,000-point level. As of Friday, the index was trading near 900.

Retail influence and capital flight shape the index landscape

Despite the recent breakout, the Kosdaq’s trajectory this year has been uneven.

Multiple prominent companies have shifted from the Kosdaq to the Kospi, weakening market depth and contributing to relative underperformance.

With fewer large-cap anchors, volatility has been amplified by retail investor dominance, particularly during periods of policy uncertainty or global risk-off sentiment.

Still, policy expectations could mark a pivotal turning point for the index.

Whether the Kosdaq can close the performance gap with the Kospi may depend heavily on whether the proposed tax incentives and institutional investment programs materialize.

For now, traders are watching for formal government announcements in the coming weeks.

If confirmed, new incentives may help strengthen liquidity, draw long-term capital back into growth sectors, and support the Kosdaq’s push toward the 1,000 mark.

The post Kosdaq rallies on hopes of government support as investors await tax incentive details appeared first on Invezz