SMX stock exploded more than 200% on Friday, after unveiling a breakthrough molecular verification system designed for aerospace metals.

The market’s overwhelming reaction was fueled by expectations that SMX’s new technology, embedding permanent, non-separable chemical signatures into titanium and specialty alloys, could soon become the industry’s default for traceability.

Friday’s dizzying rally reflects investor bets on rapid commercial adoption, regulatory shifts, and validation across multiple sectors.

Breakthrough tech solves aerospace traceability problem

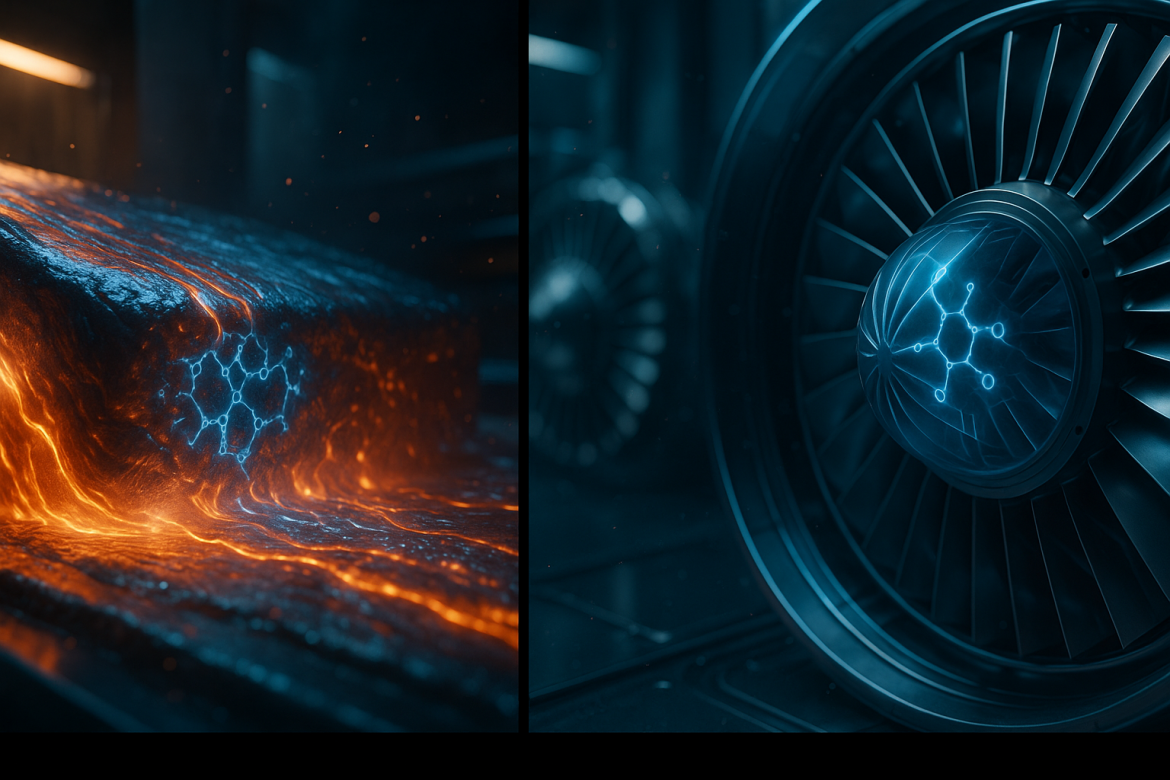

At the core of SMX’s headline-grabbing move is its molecular-level verification technology, which goes far beyond barcodes or surface tagging.

Engineers have developed a system that embeds unique chemical signatures deep within titanium, vanadium, and specialty alloys, signatures that endure through intense melting, forging, and every stage of the aerospace manufacturing process.

This breakthrough enables companies to trace metals from the minute they leave the mine, through each phase of processing and machining, right up to a jet engine or advanced propulsion part.

The upshot? Complete, tamper-proof, and permanent verification of origin and composition, delivered at the molecular level.

From proof-of-concept to industry standard

The aerospace sector faces relentless pressure on compliance, safety, and transparent sourcing, especially as electrification and new propulsion technologies disrupt the old model.

Legacy paperwork and certificates can be misplaced, forged, or simply separated from the material, leaving gaps that regulators and buyers have long lamented.

SMX’s system closes that gap, helping manufacturers and defense contractors answer questions of provenance instantly, with material-level proof that can’t be faked or lost.

This innovation directly supports cutting-edge aviation and defense requirements, reducing supply-chain fraud and improving risk management for high-value components.

Market reaction and validation

Investors responded emphatically to Friday’s news, sending SMX shares into the stratosphere on record trading volumes.

But the move isn’t just about hopes and hype, SMX has already announced six strategic partnerships spread across metals, textiles, rubber, and electronics, highlighting the technology’s cross-industry appeal.

Rather than an isolated proof-of-concept, these deals show growing trust that SMX’s system could be adopted as an advanced compliance standard.

As one compliance analyst put it, “Permanent, non-separable signatures change how manufacturers and regulators verify materials, that’s a game changer for aerospace supply chains.”

Looking ahead, several milestones could fuel further momentum, including regulatory certification, pilot deployments at large aerospace manufacturers, and full-scale OEM contracts.

Risks remain: execution at industrial scale, timelines for broad certification, and competition from rival authentication methods could all slow adoption.

But as one industry analyst noted, “If SMX hits its certification targets, its tech could reshape how high-value materials are sourced, traded, and monitored, from ore to orbit.”

The post Why SMX stock soared over 200% on Friday: here’s what you need to know appeared first on Invezz