The Rolls-Royce share price continues to power ahead, and is nearing the all-time high of 811p. It has jumped to 777p, up from the April 7 low when Donald Trump unveiled his reciprocal tariffs. This article explores a potential catalyst for the stock, and whether it will jump to 1,000p.

Rolls-Royce Holdings could see China orders

The civil aviation industry has largely been dominated by Boeing and Airbus, which makes the most popular planes.

China is aiming to become a major player in the industry by launching the C919s plane by Comac, a state-backed company.

The jet has already started flying in China, and the company hopes to manufacture 30 more this year.

At the same time, as China and US trade talks start, there is a likelihood that the civil aviation will be a point of discussion. For China to narrow its trade surplus with the US, it will need to place a large order from Boeing, the biggest US exporter.

The risk, however, is that the trade talks may not produce the desired results, leading to an escalation. In all this, Comac may be suffer collateral damage since the company relies on many US parts, some that don’t have an alternative.

For example, Comac’s plane uses an engine made by CFM International, a joint venture between General Electric and Safran.

Read more: Will the surging Rolls-Royce share price 1,000p in 2025?

If the US and China trade war escalates, there is a risk that Donald Trump may ban sale of this engine and other parts to Comac. It has already done that in the past by banning the sale of semiconductors to companies in the tech industry.

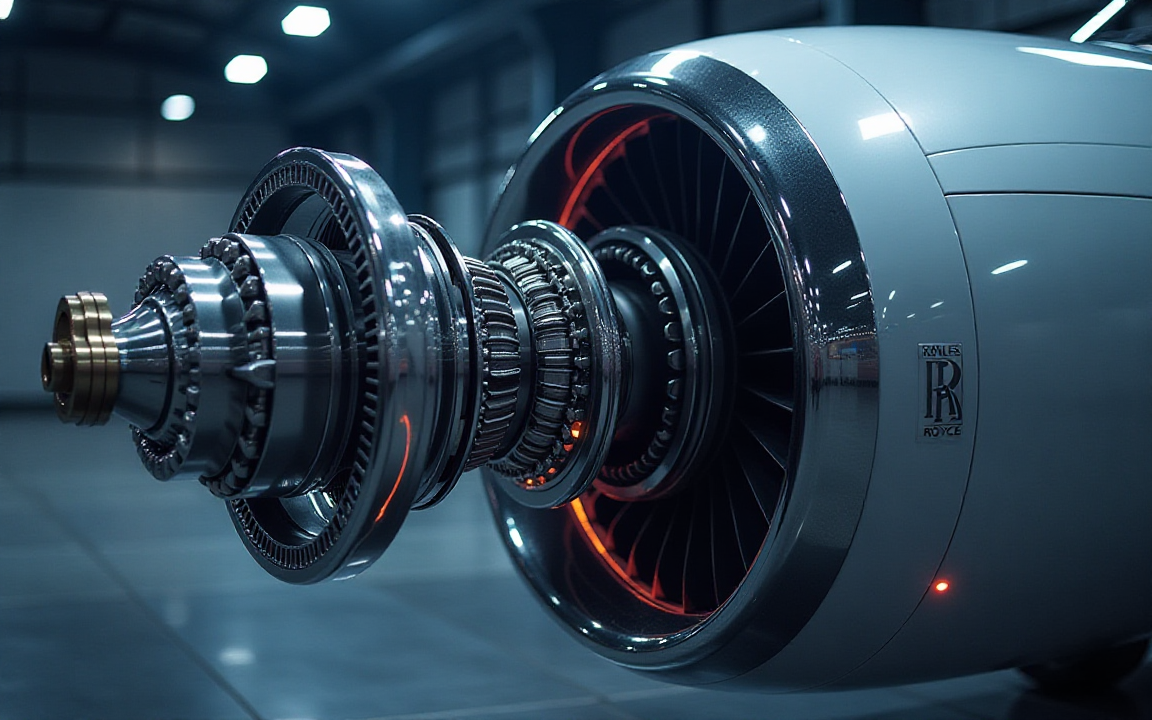

Such a move would benefit Rolls-Royce Holdings since it is the second-biggest jet engine manufacturer.

The challenge, however, is that the company does not have a narrow-body engine since it exited the industry in 2011. It is now actively exploring re-entry into the market with its UltraFan engine, which may come online in the 2030s or earlier.

Even without China, re-entry in the narrow-body engine will be a bullish catalyst for the company because of the rising demand.

The other challenge is that, for now, Comac cannot be a sustainable company without American parts. It has at least 48 suppliers from the United States, including companies like Collin Aerospace, Parker, Honeywell, and Arconic.

Rolls Royce business is doing well

The Rolls-Royce share price is also rising as the market reacts to the recent trading statement. In a brief report, the management reaffirmed its forward guidance and maintained that it will do well even with Donald Trump’s tariffs.

The company anticipates that its underlying profit and free cash flow will be between £2.7 billion and £2.9 billion. Its large engine flying hours rose to 10% of 2019 levels, while its defence and power business is seeing strong demand.

Rolls-Royce share price technical analysis

The daily chart shows that the RR stock price has been in a strong bullish trend after bottoming at 557p in April. It is now nearing the important resistance level at 811p, the highest level this year.

Moving above that level will point to more gains this year as it will invalidate the double-top pattern that has been forming and whose neckline is at 557p. A double-top is one of the most bearish patterns in the market.

Moving above that resistance will point to more gains, with the initial target being 850p. A move above that level will lead to more gains, potentially to the next psychological barrier at 1,000p. Such a move would push its market cap to £83 billion or $106 billion.

The post RollS-Royce share price forecast: extremely bullish above 810p appeared first on Invezz