Rolls-Royce share price has moved sideways this month as the recent bullish momentum eased. RR stock was trading at 887p on Monday, a few points below the year-to-date high of 912p.

Rolls Royce is still one of the best-performing companies in the FTSE 100 Index as it jumped by 52% this year and 750% in the last five years. This surge has transformed it into one of the biggest industrial companies with a market capitalization of $101 billion.

Rolls-Royce and the civil aviation tailwinds

Rolls-Royce Holdings share price has done well in the past few months, helped by the strong civil aviation business.

Chinese airlines are considering making almost 500 orders in July when European officials visit the country to celebrate 50 years of trade.

These orders will come after Airbus dominated the recent Paris Air Show. As per Reuters, the new orders are worth over $21 billion, one of the biggest hauls in recent years.

Some of these orders came from AviLease, a Saudi Arabian leasing company. Other top clients were Japan’s ANA, Poland’s LOT, VietJet Air, EgyptAir, and Starlux Airlines.

Airbus’s strength, especially in the wide-body industry, benefits Rolls-Royce Holdings directly because it is one of the biggest engine suppliers.

This performance also explains why GE Aviation, another top engine manufacturer, has done well this year. Its stock has jumped by 42% this year and nearly 50% in the last 12 months. This growth has brought its market capitalization to over $255 billion.

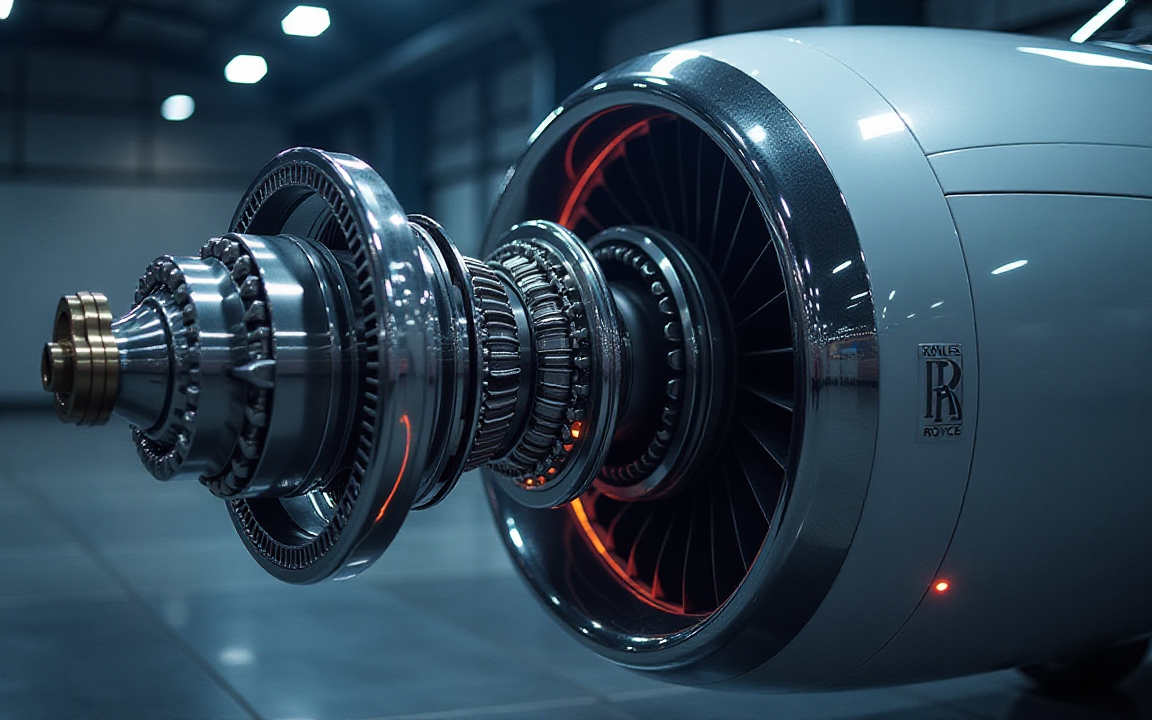

For starters, Rolls-Royce Holdings is one of the top aircraft engine manufacturers. In addition to selling engines, the company makes most of its money through Long-Term Service Agreements (LTSA) under its TotalCare and CorporateCare solutions.

Rolls-Royce’s LTSA solution includes maintenance, repairs, overhauls, and spare parts for airlines. A contract lasts between 8 and 12 years, and companies usually pay them per flying hours.

Read more: Up 909% in 3 years: can Rolls-Royce sustain its rally?

Defense and power growth

In addition to its civil aviation business, Rolls-Royce is also a major player in the defense industry. It provides military aero engines that power popular planes like the Eurofighter Typhoon.

Rolls-Royce also provides the LiftSystem for F-35 Joint Strike Fighter aircraft and other solutions. The company is also a major provider of naval propulsion systems and submarines.

This segment is growing as European, Asian, and American countries boost their defense spending. The most recent results show that its defense segment attracted an order intake of £13.3 billion last year. This included an eight-year submarine contract with the UK Ministry of Defence.

Its defence revenue increased by 13% to £4.5 billion, while its operating profit rose by 16% to £644 million. Its operating margin also jumped by 14.2%.

The company is also becoming a major player in the Small Modular Reactors (SMR) business. It has already won contracts by CEZ Group, the main Czech power utility. It was also selected to supply these solutions by the UK government.

Rolls-Royce’s power business is also doing well because of the rising demand from data center companies.

Rolls-Royce share price analysis

RR stock price chart | Source: TradingView

The daily chart shows that the RR stock price has been in a strong uptrend on the past few months. It bottomed at 557p in April and then rebound to 887p today.

The ongoing Rolls-Royce share price consolidation is happening after it found strong resistance at 911p. It is common for stocks to waver after hitting a crucial resistance level.

Rolls-Royce stock price has remained above the 50-day and 100-day Exponential Moving Average (EMA), a sign that bulls are in control. It has also formed a bullish pennant pattern, a popular continuation sign.

Therefore, the stock will likely continue rising as bulls target the key psychological point at 1,000p.

The post Rolls-Royce share price has stalled: will the surge resume? appeared first on Invezz