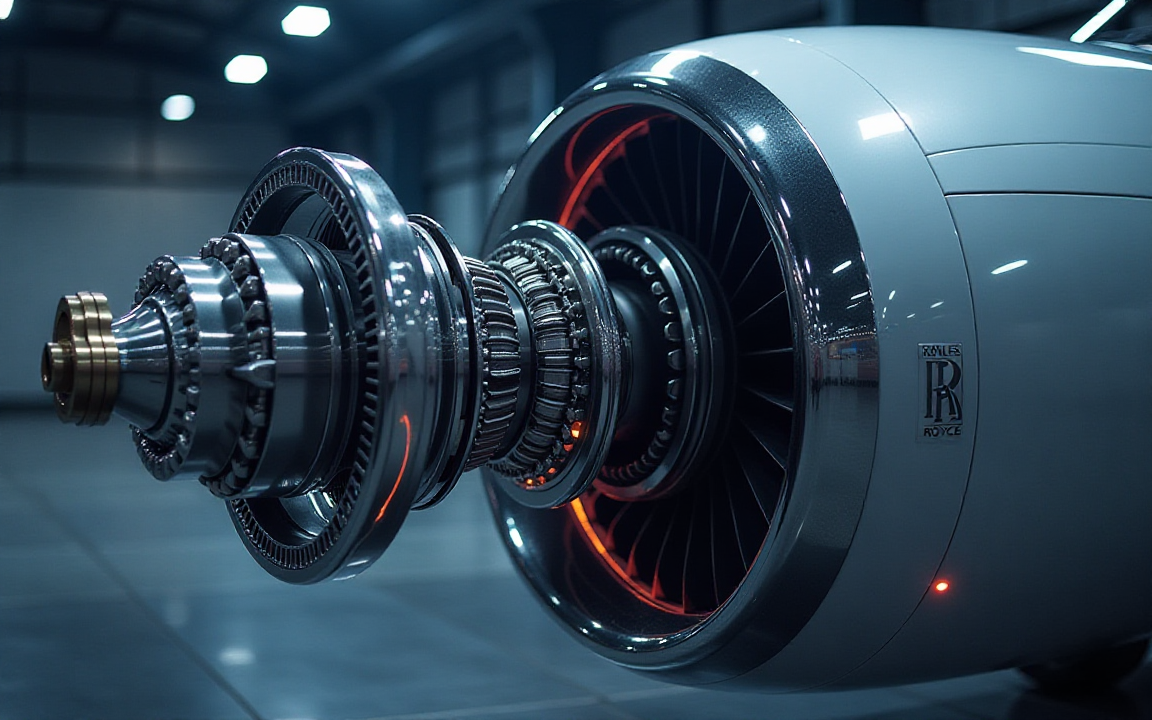

Rolls-Royce share price continued its strong rally this week as it neared the crucial resistance level at 1,000p. RR stock has surged to a high of 985p, up sharply from the year-to-date of 556p.

Rolls Royce stock price has soared by 120% in the last 12 months, giving it a market capitalization of over $112 billion, making it the eighth biggest company in the UK.

GE Aerospace earnings ahead

Rolls-Royce stock will be in the spotlight in the next few days as its top competitor publishes its financial results. GE Aerospace, the world’s largest engine manufacturer, will release its results on Wednesday.

Analysts anticipate that the company’s business will continue doing well in the second quarter. The average revenue estimate is $9.51 billion, up by 15.60% from the same period last year.

GE Aerospace’s earnings will also have higher profits, with the earnings per share (EPS) expected to come in at $1.4, higher than $1.2 last year. Most importantly, the company’s revenue is expected to come in at $40 billion, a 13% annual increase.

GE Aerospace’s results are important for Rolls-Royce because the two companies are in the same industry. As such, robust earnings, which analysts expect, will likely be a good sign for Rolls-Royce and other engine suppliers.

Read more: Rolls-Royce share price nears 1,000p as a new catalyst emerges

European and China trips

The other catalyst that may push the Rolls-Royce share price higher this month is an upcoming meeting between China and the European Union.

An EU delegation will travel to China for a summit that will happen between July 21st and 25th to celebrate relations between the two regions.

Rolls-Royce share price will be in the spotlight because of the potential for aircraft orders. As we have written before, media reports suggest that the country will likely place a nearly 500 order from Airbus.

Such an order will be beneficial to Rolls-Royce because it is one of the biggest engine providers to the company. Such a move will likely lead to more orders to the company and help it achieve its mid-term goals.

Growth is continuing

The Rolls-Royce share price is also doing well because of its strong financial results and share buyback. It is now implementing a £1 billion buyback program that it started a few months ago. It had completed £138 million of the repurchases by the end of March.

Further, the company has a strong balance sheet, with over $7.16 billion in cash and short-term investments. It ended the last quarter with over $45.7 billion in liabilities against $44 billion in total assets.

Rolls-Royce’s business is growing across all segments, including its civil aviation, power systems, and defence. Its civil aviation is doing well as flight hours and demand have surged.

The company’s power business is doing well as data center demand jumped. It is also benefiting from the small modular reactor business, while its defence segment is doing well as geopolitical risks jump.

Rolls-Royce share price analysis

The daily chart shows that the RR stock price has staged a strong bull run in the past few months. It has moved from a low of 555p in April to the current 985p.

The stock has moved above the 50-day and 100-day Exponential Moving Averages (EMA). Further, the Relative Strength Index (RSI) has moved above the overbought level.

The MACD indicator has remained above the zero line since April this year. Therefore, the stock will likely continue rising as bulls target the psychological point at 1,000p. A move above that level will point to more gains, potentially to 1,100p.

The post Top 2 catalysts for the Rolls-Royce share price in July appeared first on Invezz