Nvidia Corp. has announced a £2 billion ($2.7 billion) investment in the United Kingdom’s artificial intelligence sector, marking one of its most significant overseas expansions.

The move comes alongside collaborations with British startups, global venture capital firms, and data centre operators, aiming to position the UK as a strong hub in the international AI market.

The announcement coincided with US President Donald Trump’s visit to the UK, during which major technology companies including Microsoft and OpenAI also unveiled investment plans.

Nvidia’s financing seeks to ease challenges such as rising energy costs, limited access to supercomputing, and scarce funding faced by UK startups.

Nvidia’s investment structure and partnerships

According to Bloomberg, the investment package includes a £500 million equity stake in Nscale, a British AI data centre startup that spun out of a crypto miner just 14 months ago.

Nvidia confirmed this funding will be deployed from its balance sheet, with allocations domiciled in the US but activated in the UK.

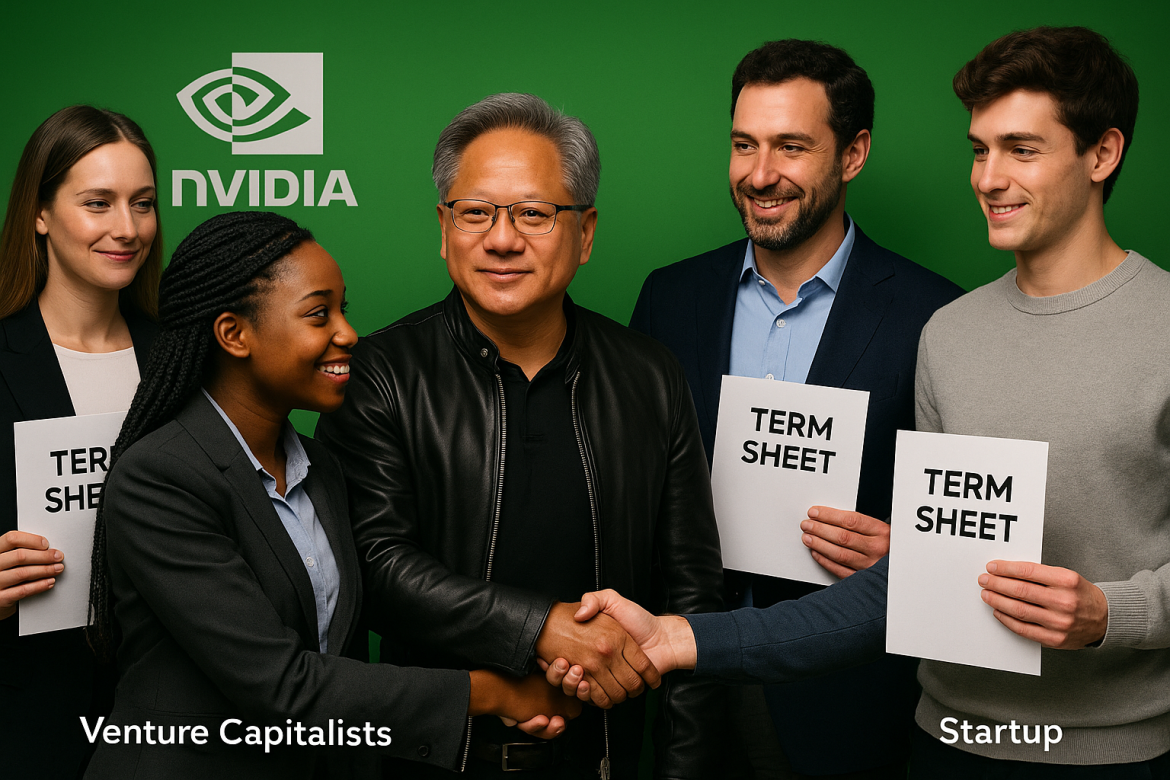

The company has partnered with well-known venture capital firms Accel, Balderton Capital, Hoxton Ventures, Phoenix Court, and Air Street Capital.

While these firms will support Nvidia in identifying promising startups, they will not necessarily co-invest in the projects.

Part of the investment is directed at autonomous vehicle technology developers Wayve and Oxa, as well as fintech company Revolut.

AI firms including PolyAI, Synthesia, Latent Labs, and Basecamp Research are also beneficiaries. Wayve separately confirmed a $500 million injection from Nvidia to accelerate the rollout of its AI model.

Funding for research and supercomputing

Nvidia said the financing would provide UK researchers and startups with much-needed access to both capital and computing resources.

The company highlighted that its UK partnerships would bring advanced supercomputing infrastructure closer to the local AI ecosystem.

This is expected to alleviate constraints such as limited processing capacity and soaring energy prices, two issues that have slowed the growth of Britain’s AI market.

The announcement follows Nvidia’s tie-up with OpenAI and Nscale for the launch of Stargate UK, a new branch of a larger American programme designed to expand AI system capacity.

The plan links back to Prime Minister Keir Starmer’s January strategy to “turbocharge AI” in Britain by supporting data centres, chip production, and establishing AI growth zones with priority planning approvals.

Political and corporate context

Nvidia’s chief executive Jensen Huang unveiled the plan in London, framing it as part of a broader shift to strengthen transatlantic technology ties.

Huang joined Trump at a state banquet at Windsor Castle alongside King Charles III, underlining the high-level political backdrop to the announcement.

The United Kingdom remains Europe’s biggest startup market by deal volume, hosting firms like Google’s DeepMind and other high-profile AI players, yet it has not developed a homegrown AI champion comparable to OpenAI or France’s Mistral.

With US companies increasing their footprint, the country aims to close that gap.

Nvidia’s financing adds to a series of high-value technology announcements, including Microsoft and OpenAI’s UK commitments, which together amount to tens of billions of dollars.

Prime Minister Starmer described Nvidia’s move as a long-term boost to the country’s standing in global technology, aligning with his administration’s goal of using private sector partnerships to reinforce Britain’s AI competitiveness.

The post Nvidia backs UK AI sector with $2.7B investment in startups, supercomputing appeared first on Invezz