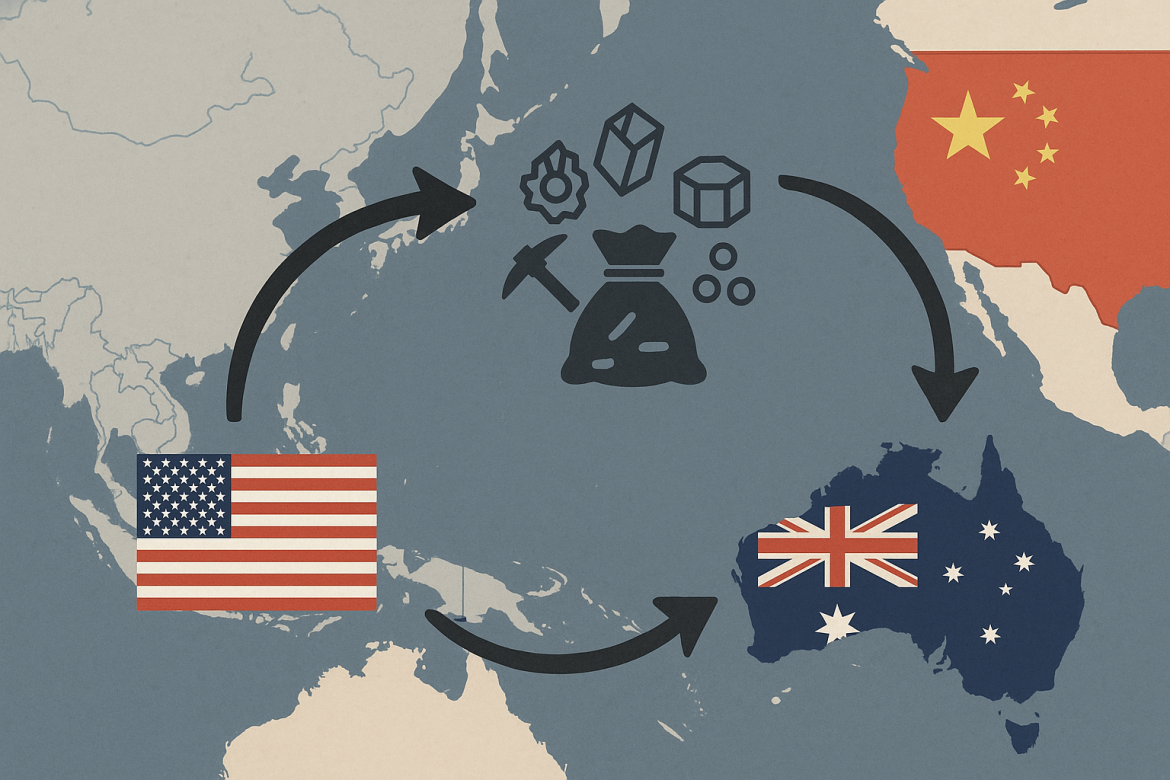

China has responded to the recent agreement between the United States and Australia on critical minerals by urging resource-rich nations to ensure stable supply chains, signalling a fresh phase in the global strategic competition over rare-earth materials.

The development, CNBC reports, highlights the growing importance of minerals used in everything from electric vehicles to defence hardware, and shows how the geopolitics of mining and trade are shifting.

China emphasises global supply chain responsibility

On Tuesday, CNBC notes, a spokesperson for the Ministry of Foreign Affairs of the People’s Republic of China (MFA) said that the formation of global production and supply chains for critical minerals is “the result of market and corporate choices”.

At the same time, the statement stressed that “resource-rich nations with critical minerals should play a proactive role in safeguarding the security and stability of the industrial and supply chains, and ensure normal economic and trade cooperation”.

This statement follows the recent agreement signed on Monday between the Donald Trump administration in the United States and the Anthony Albanese government in Australia, which aims to boost supplies of rare earths and other critical minerals.

According to CNBC, the deal, described as being worth US$8.5 billion, was negotiated amidst rising concern over China’s dominant position in the global rare-earth market.

China’s reaction frames the race for critical minerals not simply as a bilateral competition between Washington and Canberra, but as a broader call to nations with mineral wealth to assume responsibility for supply chain stability.

In doing so, Beijing appears to be seeking to shape the narrative and to cast itself as defender of multilateral norms against bloc-based alignments.

US-Australia deal raises the stakes in mineral geopolitics

Under the agreement, the United States and Australia intend to collaborate on mining and processing projects targeting rare earths and other critical minerals.

The deal comes shortly after China introduced more stringent export controls on rare earths and technologies related to processing and magnets.

According to analysts, the pact marks a significant step by the United States to diversify away from China’s supply chain dominance.

The two nations plan to fast-track investment in mining, refining, and downstream manufacturing, with explicit references in documentation to price-floor mechanisms and other market stabilisation tools.

Australia, in particular, is viewed as a key partner, given its advanced mining sector and relatively underdeveloped downstream capabilities.

In announcing the deal, the US and Australia signalled they aim to reduce dependence on China, which currently controls a large share of global rare-earth production and processing capacity.

However, experts caution that shifting these supply chains will take many years—even as long as a decade or more—given the technical complexity and high capital costs involved.

China’s strategy and the message to other countries

By issuing its recent statement, as per Bloomberg, China is sending several signals.

First, Beijing is reaffirming its position as a major player in the critical minerals domain and reminding the world that supply-chain decisions are subject to market and corporate dynamics, in which China currently plays a central role.

Second, China is challenging the US-Australia initiative as part of a broader alliance strategy, suggesting that independent, resource-rich countries should not be drawn into bloc-style competition.

Third, the remarks implicitly raise the prospect of further Chinese export controls or licensing regimes that could weaponise its dominant position.

China’s export adjustments earlier this month required foreign firms to seek approval for exporting magnets or components containing Chinese-origin rare earths, signalling the country is willing to use regulatory tools to exert influence.

The MFA comments follow this shift and appear designed to encourage other mineral-rich nations to partner with China or at least remain neutral in the evolving supply-chain landscape.

What comes next for the global critical minerals market

The immediate impact of the US-Australia agreement is likely to include increased investment activity in mining and processing projects in Australia, backed by letters of interest and financing from the US Export-Import Bank.

Australian-listed mining firms have already seen share-price reactions as a result.

At the same time, the message from China adds a dimension of strategic caution: countries with rare-earth deposits may find themselves navigating competing offers and aligning decisions with shifting geopolitical pressures.

In the longer term, the challenge will be to build alternative supply chains with the scale and technical depth to rival China’s dominance.

Industry observers, CNBC reports, note that mining is only one part of the equation: refining, separation, magnet production, and end-use manufacturing all require heavy capital investment and technical know-how.

For countries rich in minerals, the decision to “play a proactive role” means investing not just in extraction, but in the entire value chain.

The post China pushes for stable critical-minerals supply after US-Australia deal appeared first on Invezz